UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by Registrant | ☒ | |

| Filed by Party other than Registrant | ☐ | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Materials Pursuant to §240.14a-12 | |||

COCRYSTAL PHARMA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| $_____ per share as determined under Rule 0-11 under the Exchange Act. | ||

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

Cocrystal Pharma, Inc.

19805 North Creek Parkway

Bothell, WA 98011

(786) 459-1831

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2022

To the Stockholders of Cocrystal Pharma, Inc.:

We are pleased to invite you to attend our 2022 Annual Meeting of Stockholders (the “Annual Meeting”), which will be held at 2:00 p.m. EST on May 18, 2022. The Annual Meeting is being held to:

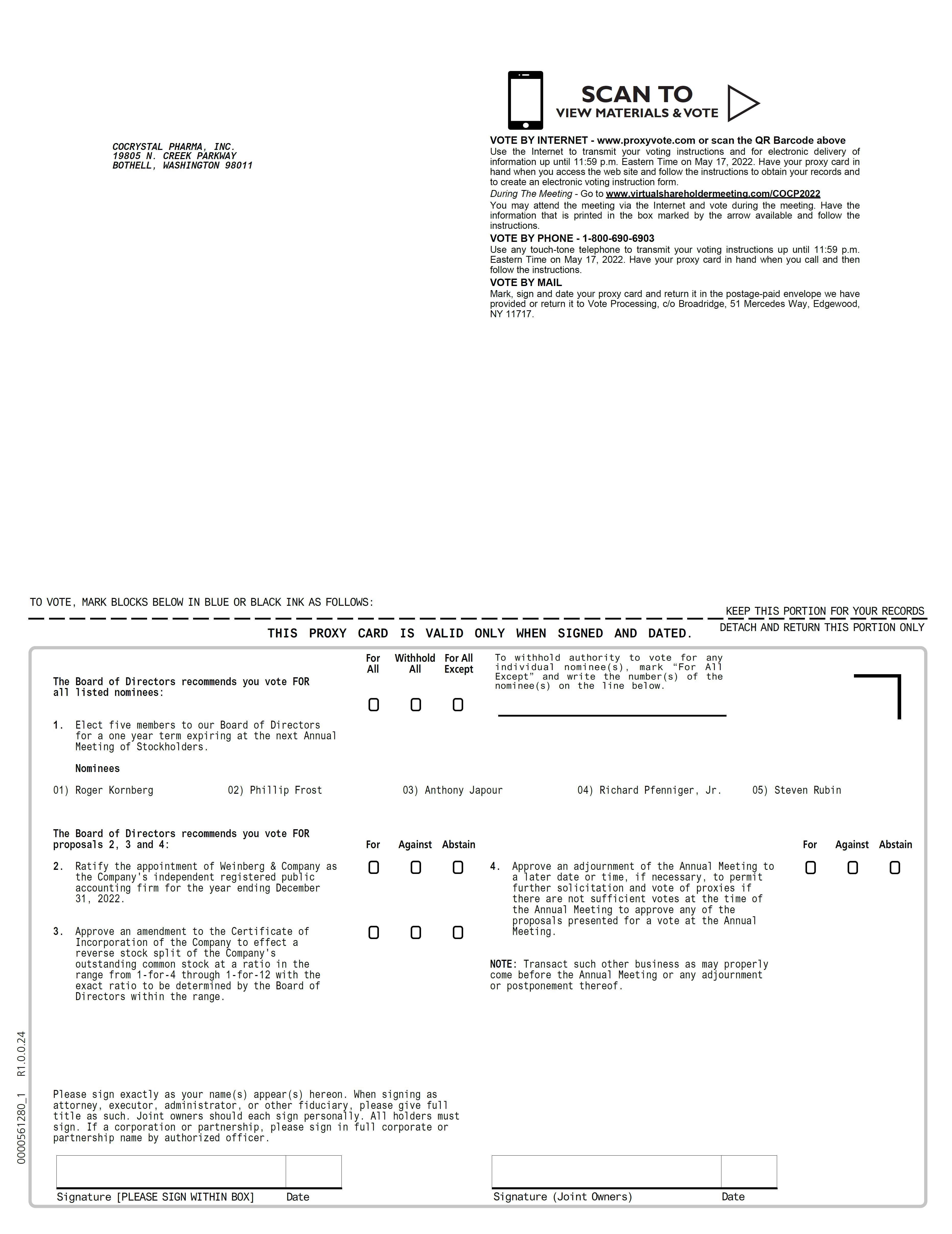

1. Elect five directors for a one-year term expiring at the next annual meeting of stockholders;

2. Ratify the selection of Weinberg & Company as the Company’s independent registered public accounting firm for the year ending December 31, 2022;

3. Approve an amendment to our Certificate of Incorporation to effect a reverse stock split of our issued and outstanding shares of common stock, par value $0.001 per share, at a ratio to be determined in the discretion of our Board of Directors within a range of one-for-four through one-for-12 (the “Reverse Split”);

4. Approve an adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if there are not sufficient votes at the time of the Annual Meeting to approve any of the proposals presented for a vote at the Annual Meeting; and

5. Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Our Board of Directors has fixed the close of business on April 11, 2022 as the record date for a determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting

to Be Held on May 18, 2022:

The Notice, Proxy Statement and 2021 Annual Report on Form 10-K are available at www.proxyvote.com.

This year, our Annual Meeting will be accessible through the Internet. You can attend our Annual Meeting by visiting www.virtualshareholdermeeting.com/COCP2022. The Annual Meeting will be conducted via live webcast. To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form. We have adopted a virtual format for our Annual Meeting to protect the health and well-being of our employees, directors, stockholders and other stakeholders in light of the ongoing COVID-19 pandemic. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders from any geographic location with Internet connectivity.

Whether or not you expect to participate in the Annual Meeting, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by phone or by signing, dating, and returning the enclosed proxy card will save us the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today.

| By the Order of the Board of Directors: | |

| /s/ James Martin | |

| James Martin | |

| Corporate Secretary |

April 11, 2022

If you have any questions or require any assistance in voting your shares, please call:

Alliance Advisors LLC

(833) 501-4834

Table of Contents

Cocrystal Pharma, Inc.

19805 North Creek Parkway

Bothell, WA 98011

(786) 459-1831

2022 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This Proxy Statement is being made available to the holders of shares of the voting stock of Cocrystal Pharma, Inc., a Delaware corporation (“Cocrystal” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the 2022 Annual Meeting of Stockholders of Cocrystal (the “Annual Meeting”) to be held at 2:00 pm EST on May 18, 2022. The Annual Meeting will be a virtual meeting via live webcast over the Internet. You will be able to attend the Annual Meeting, vote your shares and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/COCP2022. The proxy materials are first being mailed to our stockholders on or about April 11, 2022.

Who is entitled to vote?

Our Board has fixed the close of business on April 11, 2022 as the record date for a determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. On the record date, there were 97,468,755 shares of common stock issued, outstanding and entitled to vote. Each share of Cocrystal common stock represents one vote that may be voted on each matter that may come before the Annual Meeting. As of the record date, Cocrystal had issued no preferred stock that is entitled to vote.

What is the difference between holding shares as a record holder and as a beneficial owner?

If your shares are registered in your name with Equity Stock Transfer, our transfer agent, you are the “record holder” of those shares. If you are a record holder, this Proxy Statement has been provided directly to you by Cocrystal.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these materials have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the meeting and how do I attend?

Record holders and beneficial owners may attend the Annual Meeting. This year the Annual Meeting will be held entirely online via live webcast.

| 1 |

Set forth below is a summary of the information you need to attend the virtual Annual Meeting:

| ● | Visit www.virtualshareholdermeeting.com/COCP2022 to access the live webcast; | |

| ● | Stockholders can vote electronically and submit questions online while attending the Annual Meeting; To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form; | |

| ● | Instructions on how to attend and participate in the virtual Annual Meeting, including how to demonstrate proof of stock ownership, are also available at www.virtualshareholdermeeting.com/COCP2022. |

Stockholders may vote electronically and submit questions online while attending the virtual Annual Meeting.

How do I vote?

If you are a stockholder of record, you may vote:

| 1. | By Internet. The website address for Internet voting is on your proxy card. | |

| 2. | By phone. Call 1 (800) 690-6903 and follow the instructions on your proxy card. | |

| 3. | By mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States). | |

| 4. | In person: Visit www.virtualshareholdermeeting.com/COCP2022 to vote at the virtual Annual Meeting. |

If you vote by Internet or phone, please DO NOT mail your proxy card.

If your shares are held in street name, you may vote:

| 1. | By Internet. The website address for Internet voting is on your voting instruction form provided by your bank, broker, or similar organization. | |

| 2. | By mail. Mark, date, sign and mail promptly the enclosed voting instruction form provided by your bank or broker. | |

| 3. | In person: Visit www.virtualshareholdermeeting.com/COCP2022 to vote at the virtual Annual Meeting. |

If you are a beneficial owner, you must follow the voting procedures of your nominee included with your proxy materials. If your shares are held by a nominee and you intend to vote at the Annual Meeting, please be ready to demonstrate proof of your beneficial ownership as of the record date (such as your most recent account statement as of the record date, a copy of the voting instruction form provided by your broker, bank, trustee or nominee, or other similar evidence of ownership) and a legal proxy from your nominee authorizing you to vote your shares.

What constitutes a Quorum?

To carry on the business of the Annual Meeting, we must have a quorum. A quorum is present when a majority of the outstanding shares of stock entitled to vote, as of the record date, are represented in person or by proxy. Shares owned by Cocrystal are not considered outstanding or considered to be present at the Annual Meeting. Broker non-votes (because there are routine matters presented at this Annual Meeting) and abstentions are counted as present for the purpose of determining the existence of a quorum.

| 2 |

What happens if Cocrystal is unable to obtain a Quorum?

If a quorum is not present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit solicitation of proxies.

What if I sign and return my proxy without making any selections?

If you are the stockholder of record, and you sign and return a proxy card without giving specific voting instructions, then your shares will be voted “FOR” Proposals 1, 2 and 3. If other matters properly come before the Annual Meeting, the proxy holders will have the authority to vote your shares at their discretion.

How Many Votes are Needed for Each Proposal to Pass?

| Proposals | Vote Required | ||

| 1. | Election of directors; | Plurality | |

| 2. | Ratification of the selection of our independent registered public accounting firm | Majority of the shares present and entitled to vote on the matter | |

| 3. | Approval of an amendment to the Certificate of Incorporation to Effect a Reverse Stock Split | Majority of outstanding shares of common stock | |

| 4. | Adjournment of the Annual Meeting | Majority of the shares present and entitled to vote on the matter | |

Election of Directors. In order to be elected to the Board, each nominee must receive a plurality of the votes cast. This means that the director nominees who receive the highest number of votes “FOR” their election are elected.

Ratification of the Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter is required for the ratification of the selection of the independent registered public accounting firm.

Approval of an Amendment to the Certificate of Incorporation to Effect a Reverse Stock Split. The affirmative vote of a majority of the shares of common stock outstanding is required to approve the amendment to the Certificate of Incorporation to effect the Reverse Split.

| 3 |

Adjournment of the Annual Meeting. The affirmative vote of a majority of the shares present at the Annual Meeting in person or represented by proxy and entitled to vote on the matter is required to approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if there are not sufficient votes at the time of the Annual Meeting to approve any of the proposals presented for a vote at the Annual Meeting.

What are the Voting Procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. On Proposals 2, 3, and 4 you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the proxy card or your voting instruction form.

How are abstentions treated?

| Proposals | Effect

of Abstentions on the Proposal | ||

| 1. | Election of directors | Not applicable | |

| 2. | Ratification of the selection of our independent registered public accounting firm | Against | |

| 3. | Approval of an amendment to the Certificate of Incorporation to effect a Reverse Stock Split | Against | |

| 4. | Adjournment of the Annual Meeting | Against | |

Abstentions will have the same effect as a vote “AGAINST” Proposals 2, 3 and 4. Withheld votes will not have any effect on Proposal 1.

What if I am a beneficial owner and I do not give the nominee voting instructions?

If your shares are held in street name, you must instruct the organization that holds your shares how to vote. Such organization is bound by the rules of the New York Stock Exchange, or NYSE, regarding whether or not it can exercise discretionary voting power for any particular proposal in the absence of voting instructions from you. Brokers have the authority to vote shares for which their customers do not provide voting instructions on certain “routine” matters. A broker non-vote occurs when a nominee who holds shares for another does not vote on a particular matter because the nominee does not have discretionary voting authority for that item and has not received instructions from the owner of the shares or when a broker for its own internal reasons elects not to vote uninstructed shares. Broker non-votes are included in the calculation of the number of votes deemed present at the meeting for purposes of determining the presence of a quorum.

| 4 |

The table below sets forth, for each proposal, whether a nominee organization can exercise discretion and vote your shares absent your instructions and if not, the impact of such broker non-vote on the approval of the proposal.

| Proposal | Broker Discretionary Vote Allowed |

Impact of Broker Non- Vote* | |||

| 1. | Election of directors | No | None | ||

| 2. | Ratification of the selection of our independent registered public accounting firm | Yes | N/A | ||

| 3. | Approval of an amendment to the Certificate of Incorporation to effect a Reverse Stock Split | Yes | N/A | ||

| 4. | Adjournment of the Annual Meeting | Yes | N/A | ||

*If you do not provide voting instructions, your shares will not be voted on any non-routine proposal. Proposals 2, 3 and 4 are considered “routine” proposals, while Proposal 1 is considered a “non-routine” proposal. As a result, if you do not provide voting instructions to your nominee organization, your shares will not be voted on Proposal 1. Broker non-votes do not count as a vote “FOR” or “AGAINST” Proposal 1, and accordingly will have no impact on the outcome of that Proposal. For Proposals 2, 3 and 4, while broker discretionary voting is permitted under NYSE Rules, an increasing number of brokers and similar organizations which hold shares in street name have elected to either refrain from discretionary voting or engage in a form of proportionate voting such as voting shares in a manner consistent with all other votes cast at the meeting. As a result, while broker discretionary voting could result in a vote “FOR” Proposals 2, 3 or 4 for some or all instances in which a beneficial stockholder declines to provide instructions for voting his, her or its shares, we cannot predict what the ultimate outcome will be as it depends on the organization which has custody of the shares in each such case.

Is My Proxy Revocable?

If you are a stockholder of record, you may revoke your proxy and reclaim your right to vote up to and including the day of the Annual Meeting by giving written notice of revocation to the Corporate Secretary of Cocrystal bearing a later date than your proxy, by executing and delivering to the Corporate Secretary of Cocrystal a proxy card dated after the date of your proxy, or by voting in person at the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Cocrystal Pharma, Inc., 4400 Biscayne Boulevard, Miami, FL 33137.

If your shares are held in street name, you may change your vote by following your nominee’s procedures for revoking your proxy or changing your vote.

Who is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by Cocrystal. In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing. We have retained Alliance Advisors LLC to assist in proxy solicitation for an estimated fee of $9,000 plus disbursements, reasonable out of pocket expenses and varying fees per investor communication. If you have any questions or require any assistance in voting your shares, please call Alliance Advisors LLC at (833) 501-4834.

What Happens if Additional Matters are Presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you submit a signed proxy card, the persons named as proxy holders, Messrs. James Martin and Sam Lee, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. If for any reason any of our nominees is not available as a candidate for director, the persons named as proxy holders will vote your shares “FOR” such other candidate or candidates as may be properly nominated by the Board.

What is “householding” and how does it affect me?

Record holders who have the same address and last name will receive only one copy of the printed proxy materials, unless we are notified that one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees.

If you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of the proxy materials, or if you hold Cocrystal stock in more than one account, and in either case you wish to receive only one copy of each of these documents for your household, please contact our Corporate Secretary at: 4400 Biscayne Boulevard, Miami, FL 33137.

| 5 |

If you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to Cocrystal stockholders with any of the proposals brought before the Annual Meeting.

Can a Stockholder Present a Proposal To Be Considered At the 2023 Annual Meeting?

If you wish to submit a proposal to be considered at the 2023 annual meeting of stockholders, the following is required:

| ● | For a stockholder proposal to be considered for inclusion in Cocrystal’s Proxy Statement and proxy card for the 2023 annual meeting of stockholders (the “2023 Annual Meeting”) pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) our Corporate Secretary must receive the written proposal no later than December 12, 2022, which is 120 calendar days prior to the anniversary date Cocrystal’s Proxy Statement was released to the stockholders in connection with the Annual Meeting. Such proposals also must comply with SEC regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company sponsored materials. | |

| ● | Our Bylaws include advance notice provisions that require stockholders desiring to recommend or nominate individuals for election to the Board or who wish to present a proposal at the 2023 Annual Meeting to do so in accordance with the terms of the advance notice provisions. For a stockholder proposal or a nomination that is not intended to be included in Cocrystal’s Proxy Statement and proxy card under Rule 14a-8, our Corporate Secretary must receive the written proposal no later than 90 calendar days prior to the 2023 Annual Meeting; provided, however, that in the event that less than 100 days’ notice of public disclosure of the date of the meeting is given to stockholders, notice by the stockholder to be timely must be received no later than the close of business on the tenth day after public disclosure of the 2023 Annual Meeting is made. If a stockholder fails to meet these deadlines and fails to satisfy the requirements of Rule 14a-8 under the Exchange Act, we may exercise discretionary voting authority under proxies we solicit to vote on any such proposal as we determine appropriate. Your notice must contain the specific information set forth in our Bylaws. |

A nomination or other proposal will be disregarded if it does not comply with the above procedures. All proposals and nominations should be sent to our Corporate Secretary at 4400 Biscayne Boulevard, Miami, FL 33137.

We reserve the right to amend our Bylaws and any change will apply to the 2023 Annual Meeting unless otherwise specified in the amendment.

Interest of Officers and Directors in Matters to Be Acted Upon

Except in the election of directors, none of the officers or directors have any interest in any of the matters to be acted upon at the Annual Meeting.

Where can I find voting results of the Annual Meeting?

We will announce the results for the proposals voted upon at the Annual Meeting and publish voting results in a Current Report on Form 8-K filed within four business days after the Annual Meeting.

The Board Recommends that Stockholders Vote “FOR” Proposals 1, 2, 3 and 4.

| 6 |

PROPOSAL 1. ELECTION OF DIRECTORS

Pursuant to the authority granted to our Board of Directors (the “Board”) under our Bylaws, the Board has fixed the number of directors constituting the entire Board at five. The Board currently consists of five directors.

Upon the recommendation of the Corporate Governance and Nominating Committee of the Board, our Board has nominated the five individuals named below currently serving as directors of the Company to be elected as directors at the Annual Meeting, each to hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified.

The Board recommends a vote “For” the election of all of the director nominees.

NOMINEES FOR DIRECTOR

The following table sets forth information provided by the nominees as of the record date. All of the nominees are currently serving as directors of Cocrystal. All of the nominees have consented to serve if elected by our stockholders. There are no family relationships among our directors and executive officers.

| Name | Age | Position | ||

| Roger Kornberg | 74 | Chairman and Director | ||

| Phillip Frost | 85 | Director | ||

| Steven Rubin | 61 | Director | ||

| Anthony Japour | 62 | Director | ||

| Richard C. Pfenniger, Jr. | 66 | Director |

Director Nominees Biographies

Roger Kornberg, Chairman

Dr. Kornberg has been a director of Cocrystal since April 15, 2020. Since 1988, Dr. Kornberg has been a professor of structural biology at Stanford Medical School. Dr. Kornberg is a member of the U.S. National Academy of Sciences and the Winzer Professor of Medicine in the Department of Structural Biology at Stanford University. In 2006, Dr. Kornberg was awarded the Nobel Prize in Chemistry in recognition for his studies of the molecular basis of Eukaryotic Transcription, the process by which DNA is copied to RNA. Dr. Kornberg is also the recipient of several awards, including the 2001 Welch Prize, the highest award granted in the field of chemistry in the United States, and the 2002 Leopold Mayer Prize, the highest award granted in the field of biomedical sciences from the French Academy of Sciences. Dr. Kornberg has served as a member of the Board of Directors of Xenetic Biosciences, Inc. (NasdaqGS:XBIO) since February 2018. Additionally, from February 2012 until November 2017, Dr. Kornberg served as a director of Ophthalix Inc., currently Mawson Infrastructure Group Inc. (OTC:WIZP).

Dr. Kornberg’s prior experience serving on the boards of directors of large organizations as well as his tremendous scientific background provides him with the appropriate set of skills to serve as a member of our Board.

Phillip Frost, M.D., Director

Dr. Frost has been a director of Cocrystal since January 2, 2014 and formerly a director of Cocrystal Discovery, Inc., our subsidiary, from 2008 to 2014. He has served as CEO and Chairman of OPKO Health, Inc. (Nasdaq:OPK) (“OPKO”), a multi-national pharmaceutical and diagnostics company since March 2007. He has served as a member of the Board of Trustees of the University of Miami since 1983 and was Chairman from 2001 to 2004. He is on the Advisory Board of the Shanghai Institute for Advanced Immunochemical Studies in China, a member of The Florida Council of 100 and is a Trustee of each of the Miami Jewish Home for the Aged and the Mount Sinai Medical Center. He serves as Chairman of Temple Emanu-El, Governor of Tel Aviv University and is a member of the Executive Committee of The Phillip and Patricia Frost Museum of Science. Dr. Frost served as a director of Ladenburg Thalmann Financial Services Inc. from 2004 to 2006 and as Chairman from July 2006 until September 2018. He previously served as an Expert Member of the Scientific Advisory Council of the Skolkovo Foundation in Russia. Dr. Frost previously served as Vice Chairman of Cogint, Inc., now known as Fluent, Inc. (Nasdaq:FLNT), and as a director for Castle Brands Inc. (NYSE American:ROX), Sevion Therapeutics, Inc. prior to its merger with Eloxx Pharmaceuticals, Inc. (Nasdaq:ELOX), and TransEnterix, Inc., now known as Asensus Surgical, Inc. (NYSE American:ASXC).

| 7 |

Dr. Frost has successfully founded several pharmaceutical companies and overseen the development and commercialization of a multitude of pharmaceutical products. This combined with his experience as a physician and chairman and/or chief executive officer of large pharmaceutical companies has given him insight into virtually every facet of the pharmaceutical business and drug development and commercialization process. He is a demonstrated leader with keen business understanding and is uniquely positioned to help guide our Company.

Steven D. Rubin, Director

Mr. Rubin has been a director of Cocrystal since January 2, 2014 and a director of Cocrystal Discovery since 2008. Mr. Rubin has been the Executive Vice President of OPKO, since May 2007 and a director of OPKO since February 2007. In addition to OPKO, Mr. Rubin currently serves on the board of directors of Red Violet, Inc. (NASDAQ CM:RDVT), a software and services company, Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company, Eloxx Pharmaceuticals, Inc. (Nasdaq:ELOX), a clinical stage biopharmaceutical company dedicated to treating patients suffering from rare and ultra-rare disease caused by premature termination codon nonsense mutations, Neovasc, Inc. (Nasdaq CM:NVCN), a company that develops and markets medical specialty vascular devices, and ChromaDex Corp. (Nasdaq CM:CDXC), a science-based, integrated nutraceutical company devoted to improving the way people age. Mr. Rubin previously served as a director of VBI Vaccines, Inc. (Nasdaq CM:VBIV), a biopharmaceutical company developing next generation vaccines, BioCardia, Inc.(NASDAQ GS: BCDA), a clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases, Cogint, Inc. (NASDAQ GM:COGT), now known as Fluent, Inc. (Nasdaq:FLNT), an information solutions provider focused on the data-fusion market, prior to the spin-off of its data and analytics operations and assets into Red Violet, Inc., Kidville, Inc. (OTCBB:KVIL), which operates large, upscale facilities, catering to newborns through five-year-old children and their families and offers a wide range of developmental classes for newborns to five-year-olds, Sevion Therapeutics, Inc., prior to its merger with Eloxx Pharmaceuticals, Inc., Dreams, Inc. (NYSE American:DRJ), a vertically integrated sports licensing and products company, SciVac Therapeutics, Inc. prior to its merger with VBI Vaccines, Inc., Tiger X Medical, Inc. prior to its merger with BioCardia, Inc., and Castle Brands, Inc. (NYSE American:ROX), a developer and marketer of premium brand spirits.

Mr. Rubin’s qualifications to serve on our Board include extensive leadership, business, and legal experience, as well as tremendous knowledge of our business and the pharmaceutical industry generally. He has advised pharmaceutical companies in several aspects of business, regulatory, transactional, and legal affairs for almost 30 years. His experience as a practicing lawyer, general counsel, and board member to multiple public companies, including several pharmaceutical and life sciences companies, has given him broad understanding and expertise, particularly relating to strategic planning and acquisitions.

| 8 |

Anthony Japour, M.D., Director

Dr. Japour has been a director of Cocrystal since April 4, 2019. Since June 2021, Dr. Japour has been the Chief Executive Officer of iTolerance, Inc. Since March 2021, Dr. Japour has served on the board of directors of Sanaby Health Acquisition Corp. I. (Nasdaq:SANB). From February 2016 through May 2020, Dr. Japour was a medical director at ICON Plc, a global provider of outsourced development services to the pharmaceutical, biotechnology and medical device industries. Additionally, since November 2006, Dr. Japour has been the principal of Anthony Japour & Associates, Medical and Scientific Consulting, Inc., a consulting company. From January 6, 2020 until June 2020, Dr. Japour served as a director of OPKO and its Audit Committee. Dr. Japour self identifies as openly gay, and therefore qualifies as diverse under the Nasdaq Rule.

Dr. Japour was designated by Dr. Raymond Schinazi, our principal stockholder, pursuant to the Stockholder Rights Agreement, dated November 24, 2014. Dr. Japour’s qualifications to serve on our Board include his over 25 years of experience in the pharmaceutical and biotechnology businesses. Additionally, Dr. Japour has extensive experience in the clinical trial process.

Richard C. Pfenniger, Jr., Director

Mr. Pfenniger has been a director of Cocrystal since May 27, 2021. Mr. Pfenniger is a private investor. During his career, Mr. Pfenniger has served as an executive officer of several companies, including as Chief Executive Officer and President of Continuecare Corporation, a provider of primary care physician and practice management services, form 2003 until 2011, where he also served as Chairman of the Board of Directors of Continuecare Corporation from 2002 to 2011. Previously, Mr. Pfenniger served as the Chief Executive Officer and Vice Chairman of Whitman Education Group, Inc. from 1997 through June 2003. Prior to joining Whitman, he served as the Chief Operating Officer of IVAX from 1994 to 1997, and, from 1989 to 1994, he served as the Senior Vice President-Legal Affairs and General Counsel of IVAX Corporation. Prior thereto he was engaged in the private practice of law. Mr. Pfenniger currently serves as a director of Asensus Surgical, Inc. (NYSE American:ASXC), a medical device company, and OPKO, a multi-national pharmaceutical and diagnostics company.

Mr. Pfenniger also serves as the Vice Chairman of the Board of Trustees and as a member of the Executive Committee of the Phillip and Patricia Frost Museum of Science. Mr. Pfenniger previously served as a director of GP Strategies Corporation (NYSE:GPX), a corporate education and training company, BioCardia, Inc. (NASDAQ:BCDA), clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases, and Wright Investors’ Services Holdings, Inc. (OTC US:IWSH), an investment management and financial advisory firm.

Mr. Pfenniger’s prior experience serving on the boards of directors of large organizations as well as his legal experience and knowledge of our business and the pharmaceutical industry provides him with the appropriate set of skills to serve as a member of our Board.

| 9 |

| Name | Age | Position | ||

| Sam Lee | 62 | Co-Interim Chief Executive Officer, President | ||

| James Martin | 55 | Co-Interim Chief Executive Officer, Chief Financial Officer |

Sam Lee, Ph.D., Co-Interim Chief Executive Officer, President

Dr. Lee has served as our President since January 2, 2014. From January 2, 2014 to November 22, 2014, Dr. Lee was a director of Cocrystal. He is a co-founder of Cocrystal Discovery and has been President and a director of Cocrystal Discovery since 2007. He has over 25 years of anti-infective drug discovery research experience. Prior to being a co-founder of Cocrystal, he managed anti-infective, oncology, and inflammation drug discovery projects for eight years at ICOS Corporation. Dr. Lee was responsible for incorporating protein crystallography and structural biology approaches into ICOS research. He received his Ph.D. in Biological Sciences from the University of Notre Dame, and completed postdoctoral training in viral replication biochemistry with Dr. I. R. Lehman at Stanford University. While at Stanford, Dr. Lee founded and was Chief Executive Officer of Viral Assays in Cupertino, CA.

James J. Martin, Co-Interim Chief Executive Officer, Chief Financial Officer

Mr. Martin has served as our Chief Financial Officer since June 1, 2017. Prior to that, from February 23, 2017 through May 30, 2017, Mr. Martin served as our Interim Chief Financial Officer. Mr. Martin has also served as Chief Financial Officer of Non-Invasive Monitoring Systems, Inc. (OTC:NIMU) since January 2011. From November 2020 through December 22, 2021, Mr. Martin served on the board of directors and as chair of the audit committee of Big Cypress Acquisition Corp (Nasdaq: BCYPU), a biotechnology focused special purpose acquisition corporation. From February 2017 to November 2020, Mr. Martin served as Chief Financial Officer of Motus GI Holdings, Inc. (Nasdaq:MOTS), a privately held medical device company. From September 2014 to November 2020, Mr. Martin served as Chief Financial Officer of VBI Vaccines Inc. (formerly SciVac Therapeutics, Inc.) (Nasdaq:VBIV), a pharmaceutical development and manufacturing company.

| 10 |

Board Committees and Charters

The Board and its committees meet and act by written consent from time to time as appropriate. The Board has formed the following three standing committees: (i) the Audit Committee, (ii) the Compensation Committee, and (iii) the Corporate Governance and Nominating Committee. These committees regularly report on their activities and actions to the Board.

Each of our Audit, Compensation, and Corporate Governance and Nominating Committees has a written charter. Each of these committee charters is available through the “Investors” section on our website, which can be found at www.cocrystalpharma.com. The information on, or that can be accessed through, our website is not incorporated into this Proxy Statement.

The following table identifies the independent and non-independent current Board and Committee members.

| Name | Independent | Audit | Compensation | Corporate Governance and Nominating | ||||

| Phillip Frost | X | X | ||||||

| Anthony Japour | X | X | X | X | ||||

| Roger Kornberg | ||||||||

| Steven Rubin | X | Chair | Chair | X | ||||

| Richard C. Pfenniger, Jr. | X | Chair |

All of the directors, then serving as directors, attended over 75% of the applicable Board and Committee meetings held in 2021.

Board and Committee Meetings

Our Board held a total of five meetings during 2021. We have no formal policy regarding attendance by directors or officers at our stockholders’ meetings.

During 2021, our Audit Committee held a total of four meetings, and the Compensation Committee and the Corporate Governance and Nominating Committee held one meeting each.

Independence

Our Board, exercising its reasonable business judgment, has determined that each of Cocrystal’s directors qualifies as an independent director pursuant to Rule 5605(a)(2) of The Nasdaq Stock Market LLC (“Nasdaq’s”) listing rules (the “Nasdaq Rules”) and applicable SEC rules and regulations, with the exception of Dr. Roger Kornberg. In considering Dr. Phillip Frost’s independence, the Board considered the large beneficial ownership position held by him directly and through entities controlled by him.

Audit Committee

The Audit Committee’s primary role is to review our accounting policies and financial reporting and disclosure processes and any issues which may arise in the course of the audit of our financial statements. The Audit Committee selects our independent registered public accounting firm, approves all audit and non-audit services, and reviews the independence of our independent registered public accounting firm, and reviews the Company’s annual and quarterly financial statements and related disclosure with our independent registered public accounting firm and management. The Audit Committee also reviews the audit and non-audit fees of the auditors. Our Audit Committee is also responsible for certain corporate governance and legal compliance matters including internal and disclosure controls and compliance with the Sarbanes-Oxley Act of 2002.

| 11 |

In addition, pursuant to its charter, which was amended and restated in 2021, the Audit Committee annually (i) reviews the Company’s financial reporting practices, critical accounting policies, and estimates; (ii) reviews significant financial risks and exposures and assesses the steps management has taken to monitor such risks and exposures; (iii) reviews issues regarding the Company’s accounting principles, including any significant changes in the Company’s selection or application of accounting principles, and the Company’s financial statement presentation; (iv) reviews issues as to the adequacy of the Company’s internal controls and compliance with applicable laws and regulations; and (v) reviews management’s attitude toward, and effectiveness in establishing, internal controls, and the efficiency of the process used to establish, monitor, and evaluate internal control systems.

Our Board has determined that each member of the Audit Committee meets the enhanced independence requirements to audit committee members under Rule 5605(c)(2) of Nasdaq Rules and under Rule 10A-3 under the Exchange Act. The Board has also determined that Steven Rubin is qualified as an Audit Committee Financial Expert, as that term is defined by Item 407(d)(5)(ii) of Regulation S-K and in compliance with the Sarbanes-Oxley Act of 2002.

Compensation Committee

The function of the Compensation Committee is to determine the compensation of our executive officers. The Compensation Committee has the power to set performance targets for determining periodic bonuses payable to executive officers and may review and make recommendations with respect to stockholder proposals related to compensation matters. Additionally, the Compensation Committee is responsible for administering our equity compensation plans including the Cocrystal Pharma, Inc. 2015 Equity Incentive Plan.

The Compensation Committee may delegate any or all of its duties or responsibilities to a subcommittee, to the extent consistent with the Company’s Certificate of Incorporation, Bylaws, applicable laws and the Nasdaq Rules.

The Board has determined that each member of the Compensation Committee meets the independence requirements under Rule 5605(a) of Nasdaq Rules and Rule 10C-1 under the Exchange Act. The Compensation Committee is comprised of two members.

Corporate Governance and Nominating Committee

The responsibilities of the Corporate Governance and Nominating Committee include the identification of individuals qualified to become Board members, the selection of nominees to stand for election as directors, the oversight of the selection and composition of committees of the Board, establish procedures for the nomination process including procedures and the oversight of the evaluations of the Board and management.

Under its charter, which was amended and restated in 2021, the Corporate Governance and Nominating Committee also monitors and enforces the Company’s related party transaction policy as set forth in the Bylaws, and conducts an annual review of any known relationships between or among all entities which file reports with the Securities and Exchange Commission (the “SEC”) that are affiliated with any Company officer or director to determine if there are any coordinated groups that are required to be reported as such in filings with the SEC.

The Board has determined that each member of the Corporate Governance and Nominating Committee meets the independence requirements under Rule 5605(a)(2) of Nasdaq Rules. The Corporate Governance and Nominating Committee is comprised of three members.

| 12 |

The Corporate Governance and Nominating Committee evaluates the suitability of potential candidates recommended by stockholders in the same manner as other candidates recommended to the Corporate Governance and Nominating Committee. If we receive any stockholder recommended nominations, the Corporate Governance and Nominating Committee will carefully review the recommendation(s) and consider such recommendation(s) in good faith. Stockholders who wish to recommend candidates for election to the Board must do so in writing. The recommendation should be sent to the Secretary of Cocrystal Pharma, Inc., at 4400 Biscayne Boulevard, Miami, FL 33137, and must be in accordance with our Bylaws with respect to nomination of persons for election to the Board.

The Corporate Governance and Nominating Committee recommended that the Board nominate each of the incumbent directors for election at the Annual Meeting.

Board Diversity

While we do not have a formal policy on diversity, our Corporate Governance and Nominating Committee, as part of its review of potential director candidates and providing recommendations to the Board, considers each candidate’s character, judgment, skill set, background, reputation, type and length of business experience, personal attributes, and a particular candidate’s contribution to that mix. While no particular criteria are assigned specific weights, the Corporate Governance and Nominating Committee believes that the backgrounds and qualifications of our directors, as a group, should provide a composite mix of experience, knowledge, backgrounds and abilities that will allow our Board to be effective, collegial and responsive to the nature of our business and our needs, and satisfy the requirements of Nasdaq Rules and the rules and regulations of the SEC. With respect to the new Nasdaq Rule concerning board diversity, one director identifies as gay, so the Company complies with this Rule.

Board Leadership Structure

While our Board has no fixed policy with respect to combining or separating the offices of Chairman of the Board and Chief Executive Officer, those two positions have been held by separate individuals since Dr. Gary Wilcox, our former Chief Executive Officer, passed away in May 2021. Prior to his passing, Dr. Wilcox had served as Chairman since February 1, 2020. Following Dr. Wilcox’s passing, Dr. Roger Kornberg was selected as Chairman of the Board, and Mr. James Martin and Dr. Sam Lee, Chief Financial Officer and President, respectively, were appointed Co-interim Chief Executive Officers to serve the functions of Dr. Wilcox’ position while the Board searches for a successor.

As a result of the foregoing events, there is some uncertainty as to the future division of managerial and Board roles for our Company as we continue our search for a permanent Chief Executive Officer. However, the Board believes that separation of the roles is the appropriate leadership structure for us at this time as it allows for sufficient Board oversight of the business and supervision of our Co-Interim Chief Executive Officers, while still providing sufficient autonomy to our management team to oversee day-to-day operations of the Company during the Board’s ongoing search and consideration of an individual to permanently hold the role of Chief Executive Officer. Further, the current separation of the roles allows the Co-Interim Chief Executive Officers to focus their time and energy on operating and managing the Company while also enabling our Company to benefit from leveraging the experience and perspectives of the Chairman against that of the Company’s senior management.

Board Assessment of Risk

The Board is actively involved in the oversight of risks that could affect Cocrystal. This oversight is conducted primarily through the Audit Committee, but the full Board has retained responsibility for general oversight of risks. The Audit Committee considers and reviews with management the adequacy of our internal controls, including the processes for identifying significant risks and exposures, and elicits recommendations for the improvements of such procedures where desirable. In addition to the Audit Committee’s role, the full Board is involved in oversight and administration of risk and risk management practices. Members of our senior management have day-to-day responsibility for risk management and establishing risk management practices, and members of management are expected to report matters relating specifically to the Audit Committee directly thereto, and to report all other matters directly to the Board as a whole. Members of our senior management have an open line of communication to the Board and have the discretion to raise issues from time-to-time in any manner they deem appropriate, and management’s reporting on issues relating to risk management typically occurs through direct communication with directors or committee members as matters requiring attention arise. Members of our senior management regularly attend portions of the Board’s meetings, and often discuss the risks related to our business.

The Board actively interfaces with management on seeking solutions to any perceived risk.

| 13 |

Compensation Policies and Practices as Related to Risk Management

The Compensation Committee and management do not believe that the Company maintains compensation policies or practices that are reasonably likely to have a material adverse effect on the Company. Our employees’ base salaries are fixed in amount and thus we do not believe that they encourage excessive risk-taking. Our Compensation Committee has in the past granted and may in the future grant in its sole discretion equity awards to employees.

The principal risks other than liquidity relate to the results of our research and development activities. Our Co-Interim Chief Executive Officer, Dr. Sam Lee, is actively involved in monitoring our research and development activities.

Code of Ethics

Our Board has adopted a Code of Ethics that applies to all of our employees, including our Co-Interim Chief Executive Officers, as well as our Board. The Code of Ethics provides written standards that we believe are reasonably designed to deter wrongdoing and promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, full, fair, accurate, timely and understandable disclosure and compliance with laws, rules and regulations, including insider trading, corporate opportunities and whistle-blowing or the prompt reporting of illegal or unethical behavior. A copy of our Code of Ethics is available through the “Investors” section on our website, which can be found at www.cocrystalpharma.com. The information on, or that can be accessed through, our website is not incorporated herein. In addition, we will provide a copy of the Code of Ethics to any person without charge, upon request. The request for a copy can be made in writing by contacting our Corporate Secretary jmartin@cocrystalpharma.com.

Stockholder Communications

Although we do not have a formal policy regarding communications with our Board, stockholders may communicate with the Board by writing to the Corporate Secretary of Cocrystal Pharma, Inc. at 4400 Biscayne Boulevard, Miami, FL 33137, or by email at: jmartin@cocrystalpharma.com. Stockholders who would like their submission directed to a member of the Board may so specify, and the communication will be forwarded, as appropriate.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of our common stock to file initial reports of ownership and changes in ownership of our common stock and other equity securities with the SEC. These individuals are required by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of the forms furnished to us, and written representations from reporting persons that no Forms 5 were required to report delinquent filings, we believe that all filing requirements applicable to our officers, directors and 10% beneficial owners were complied with during 2021.

Involvement in Certain Legal Proceedings

On September 7, 2018, the SEC filed with the United States District Court for the Southern District of New York a complaint against Dr. Philip Frost, a director and principal stockholder of the Company, a trust Dr. Frost controls and OPKO Health, Inc., a stockholder of the Company, of which Dr. Frost is the Chief Executive Officer, as well as other defendants named therein. On January 10, 2019, the District Court entered final judgments against these defendants on their consent without admitting or denying the allegations set forth in the complaint. Dr. Frost was permanently enjoined from violating a certain anti-fraud provision of the Securities Act of 1933, future violations of Section 13(d) of the Exchange Act and Rule 13d-1(a) thereunder and participating in penny stock offerings subject to certain exceptions.

| 14 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

There have been no transactions since January 1, 2020 involving the Company, in which the amount exceeded $120,000, and in which any of our directors, executive officers, beneficial owners of 5% or more of our common stock or certain other related persons had a direct or indirect material interest, and there are no such currently proposed transactions, other than compensation arrangements described in this Proxy Statement under “Executive Compensation.”

Related Party Transaction Policy

Our Bylaws, as amended and restated in 2021, provide for policies and procedures for the review, approval, or ratification of transactions with related parties. These Bylaw provisions include:

| (i) | a requirement that all directors and executive officers submit to the Board an up-to-date list of companies in which they are a director, an officer, and/or of which they own a controlling interest, and promptly update the list when any changes occur; | |

| (ii) | the implementation by the Chief Financial Officer of procedures to ensure that any material transaction that the Company is contemplating that would confer a monetary or other benefit to a party that is related to the Company or its officers will promptly be disclosed to the Board, with materiality and a party’s status as related to the Company or its officers determined based on Item 404(a) of Regulation S-K under the Exchange Act; and | |

| (iii) | a requirement that a majority of the Board approve or ratify any related-party transaction, and that timely disclosures in appropriate filings with the SEC are made of all material related party transactions. |

The Bylaws provide that in making their determination, the directors shall consider the business purpose of any proposed related-party transaction, whether the proposed transaction is on terms no less favorable than terms generally available to unaffiliated third parties under the same or similar circumstances, and whether the proposed transaction presents an improper conflict of interest for any officer or director of the Company, whether or not that officer or director is involved in the transaction. The Board may approve or ratify such transactions if it determines, after review, that they are fair to the Company and not inconsistent with the best interests of the Company and its stockholders. Any director who is interested in such a related-party transaction will be recused from any consideration of such related party transaction.

In addition, the charter of the Corporate Governance and Nominating Committee provides that the Committee will coordinate with the Chief Financial Officer to monitor and enforce the Company’s related party transaction policy, and report its findings to the Board.

See “Corporate Governance” for a discussion regarding director independence and the roles and duties of the Board and the Corporate Governance and Nominating Committee.

| 15 |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the number of shares of our common stock beneficially owned as of the record date by (i) those persons known by us to be owners of more than 5% of our common stock, (ii) each director and director nominee, (iii) each of our Named Executive Officers and (iv) all current executive officers and directors of Cocrystal as a group. Unless otherwise specified in the notes to this table, the address for each person is: c/o Cocrystal Pharma, Inc., 19805 North Creek Parkway, Bothell, WA.

| Beneficial Owner | Amount of Common Stock Owned and Nature of | Percent of Class (1) | ||||||

| Directors and Named Executive Officers: | ||||||||

| James Martin (2) | 234,475 | * | ||||||

| Sam Lee (3) | 623,762 | * | ||||||

| Phillip Frost (4) | 3,745,056 | 3.8 | % | |||||

| Anthony Japour (5) | 38,500 | * | ||||||

| Roger Kornberg (6) | 642,842 | * | ||||||

| Richard Pfenniger (7) | 40,000 | * | ||||||

| Steven Rubin (8) | 123,864 | * | ||||||

| All directors and executive officers as a group (7 persons) (9): | 5,448,499 | 5.5 | % | |||||

| 5% Holders: | ||||||||

| Raymond Schinazi (10) | 7,674,960 | 7.9 | % | |||||

| Sabby Volatility Warrant Master Fund, Ltd. (11) | 5,738,120 | 5.9 | % | |||||

* Less than 1%.

| (1) | Applicable percentages are based on 97,468,755 shares of common stock outstanding as of the April 11, 2022, which is the record date for the Annual Meeting. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock underlying options, warrants, and preferred stock currently exercisable or convertible within 60 days are deemed outstanding for the purpose of computing the percentage of the person holding such securities but are not deemed outstanding for computing the percentage of any other person. The table includes shares of common stock, options, and warrants exercisable or convertible into common stock and vested or vesting within 60 days. Unless otherwise indicated in the footnotes to this table, we believe that each of the stockholders named in the table has sole voting and investment power with respect to the shares of common stock indicated as beneficially owned by them. |

| (2) | Mr. Martin is a Named Executive Officer. Includes 234,375 vested stock options. Address is 4400 Biscayne Boulevard, Miami, FL 33137. |

| (3) | Dr. Lee is a Named Executive Officer. Includes 436,262 shares of common stock and 184,375 vested stock options. |

| (4) | Dr. Frost is a director. Includes (i) 3,655,265 shares of common stock held by Frost Gamma Investments Trust and (ii) 89,791 vested stock options. Dr. Frost is the trustee of Frost Gamma Investments Trust. Frost Gamma L.P. is the sole and exclusive beneficiary of Frost Gamma Investments Trust. Dr. Frost is one of two limited partners of Frost Gamma L.P. The general partner of Frost Gamma L.P. is Frost Gamma, Inc., and the sole stockholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is the sole stockholder of Frost-Nevada Corporation. Does not include securities held by OPKO, a corporation of which Dr. Frost is the Chief Executive Officer and Chairman, concerning the securities of which Dr. Frost does not hold voting and investment control. Dr. Frost disclaims beneficial ownership of the securities held by Frost Gamma Investments Trust and OPKO except to the extent of any pecuniary interest therein. Address is 4400 Biscayne Boulevard, Miami, FL 33137. |

| (5) | Dr. Japour is a director. Includes 38,500 vested stock options. Address is 4400 Biscayne Boulevard, Miami, FL 33137. |

| (6) | Dr. Kornberg is a director. Includes (i) 477,217 shares of common stock held by a trust of which Dr. Kornberg is the trustee, and (ii) 165,625 vested stock options. |

| (7) | Mr. Pfenniger is a director. Address is 4400 Biscayne Boulevard, Miami, FL 33137. |

| (8) | Mr. Rubin is a director. Includes 100,416 vested stock options. Address is 4400 Biscayne Boulevard, Miami, FL 33137. |

| (9) | Directors and Executive Officers as a group. This amount includes ownership by all directors and all current executive officers including Named Executive Officers and those who are not Named Executive Officers under the SEC’s disclosure rules. |

| (10) | Dr. Schinazi is our former Chairman. Address is 1860 Montreal Road, Tucker, GA 30084. Includes 15,100 vested stock options. |

| (11) | Based on a Schedule 13G/A filed by Sabby Volatility Warrant Master Fund, Ltd., Sabby Management, LLC and Hal Mintz on January 4, 2022. Sabby Management, LLC is the investment manager of Sabby Volatility Warrant Master Fund, Ltd. Hal Mintz is the Manager of Sabby Management, LLC and in such capacity has the right to vote and dispose of the securities held by Sabby Volatility Warrant Master Fund, Ltd. Address is 89 Nexus Way, Camana Bay, Grand Cayman KY1-9007. |

| 16 |

PROPOSAL 2. RATIFICATION OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected Weinberg & Company (“Weinberg”) as our independent registered public accounting firm for the year ending December 31, 2022 and our Board recommends that stockholders vote in favor of the ratification of such selection. Weinberg has been engaged as our independent registered public accounting firm since April 18, 2019.

The selection of Cocrystal’s independent registered public accounting firm is not required to be submitted to a vote of the Company’s stockholders. However, Cocrystal is submitting this matter to its stockholders for ratification as a matter of good corporate governance. Even if the selection is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during 2022 if they determine that such a change would be in the best interests of Cocrystal and its stockholders. If the selection is not ratified, the Audit Committee will consider its options.

A representative of Weinberg is not expected to be present at the Annual Meeting.

The Board recommends a vote “FOR” this Proposal 2.

The principal purpose of the Audit Committee is to assist the Board in its general oversight of our accounting practices, system of internal controls, audit processes and financial reporting processes. The Audit Committee is responsible for selecting and retaining our independent auditor and approving the audit and non-audit services to be provided by the independent auditor. The Audit Committee’s function is more fully described in its charter.

Our management is responsible for preparing our financial statements and ensuring they are complete and accurate and prepared in accordance with generally accepted accounting principles. The independent registered public accounting firm is responsible for performing an independent audit of our consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles.

The Audit Committee has:

| ● | reviewed and discussed the audited financial statements with management; | |

| ● | discussed with the independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 1301; | |

| ● | received the written disclosures and the letter from the independent registered public accounting firm, as required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed its independence with Cocrystal; and | |

| ● | in reliance on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2021 for filing with the SEC. |

This report is submitted by the Audit Committee.

Steven Rubin, Chair

Phillip Frost

Anthony Japour

The above Audit Committee Report is not deemed to be “soliciting material,” is not “filed” with the SEC and is not to be incorporated by reference in any filings that Cocrystal files with the SEC.

| 17 |

It is not the duty of the Audit Committee to determine that Cocrystal’s financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles or to plan or conduct audits. Those are the responsibilities of management and Cocrystal’s independent registered public accounting firm. In giving its recommendation to the Board, the Audit Committee has relied on: (1) management’s representations that such financial statements have been prepared with integrity and objectivity and in conformity with GAAP; and (2) the report of Cocrystal’s independent registered public accounting firm with respect to such financial statements.

Audit Committee’s Pre-Approval Policies and Procedures

Our Audit Committee reviews and approves audit and permissible non-audit services performed by our independent registered public accounting firm (the “Principal Accountant”), as well as the fees charged for such services. In its review of non-audit service and its appointment of our independent registered public accounting firm, the Audit Committee considers and considered whether the provision of such services was compatible with maintaining independence. All of the services provided and fees charged by our Principal Accountant in 2021 and 2020 were approved by the Audit Committee in accordance with its pre-approval policy.

Principal Accountant Fees and Services

The following table shows the fees billed by our Principal Accountant for the years ended December 31, 2021 and 2020.

2021 ($) | 2020 ($) | |||||||

| Audit Fees (1) | 119,000 | 141,000 | ||||||

| Audit-Related Fees (2) | - | - | ||||||

| Tax Fees (3) | - | - | ||||||

| All Other Fees (4) | 41,000 | 33,000 | ||||||

| Total | 160,000 | 174,000 | ||||||

| (1) | Audit Fees relate to the audits of our annual financial statements and the review of our interim quarterly financial statements. | |

| (2) | Audit-Related fees relate to the assessment of our internal controls. | |

| (3) | Tax Fees relate to professional services rendered by our Principal Accountant for tax compliance, tax advice and tax planning. | |

| (4) | All Other Fees relate to the filing of registration statements. |

| 18 |

PROPOSAL 3. APPROVAL OF AN AMENDMENT TO THE CERTIFICATE OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT

Our Board has adopted and submitted for stockholder approval an amendment to our Certificate of Incorporation (our “Certificate”) to effect a Reverse Split of all outstanding shares of our common stock, if the Board deems that it is in our and our stockholders’ best interests, at a ratio to be determined by the Board in the range of one-for-four through one-for-12. Our Board will have the sole discretion to elect, as it determines to be in the best interests of Cocrystal and our stockholders, whether or not to effect a Reverse Split, and if so, at which ratio within the approved range. Our Board believes that approval of a proposal granting this discretion to the Board, rather than approval of an immediate Reverse Split at a specified ratio, would provide the Board with maximum flexibility to react to current market conditions and other factors it deems appropriate and to therefore achieve the purposes of the Reverse Split, if implemented, and to act in the best interests of Cocrystal and our stockholders.

The Reverse Split has been proposed for approval at the Annual Meeting in order to attempt to remediate the Company’s current noncompliance with Nasdaq’s minimum bid price requirement under Nasdaq Rule 5550(a)(2). On November 16, 2021, Nasdaq notified the Company that the Company was not compliant with this requirement by failing to be above $1.00 per share for 30 consecutive trading days, and that the Company has until May 16, 2022 to regain compliance by having a closing bid price of at least $1.00 per share for 10 consecutive trading days, subject to a potential 180 calendar day extension of the grace period. The purpose of the Reverse Split is to regain compliance with Nasdaq’s Rule and avoid delisting of our common stock.

To effect the Reverse Split, our Board would authorize our management to file a Certificate of Amendment to our Certificate with the Delaware Secretary of State. If our Board elects to implement the approved Reverse Split within the range, the number of issued and outstanding shares of our common stock (as well as common stock underlying derivative securities such as options and warrants) would be reduced in accordance with the ratio for the selected Reverse Split. The par value of our common stock would remain unchanged, however the number of authorized and unissued shares of our common stock would increase as a result of the Reverse Split. If approved by our stockholders, our Board may nonetheless elect not to implement the Reverse Split at its sole discretion. This could occur if our common stock regains compliance with the Nasdaq Rule prior to the termination of the applicable grace period. The proposed form of amendment to our Certificate to implement the Reverse Split is attached to this Proxy Statement as Annex A.

Purpose of the Reverse Split

On November 16, 2021 the Company received a letter from Nasdaq notifying the Company of its noncompliance with Nasdaq Rule 5550(a)(2) (by failing to maintain a minimum bid price for its common stock of at least $1.00 per share for 30 consecutive trading days.

| 19 |

According to the letter, the Company has a 180 calendar day initial grace period to regain compliance with the Rule, subject to a potential 180 calendar day extension, as described below. To regain compliance, the Company’s common stock must have a minimum closing bid price of at least $1.00 per share for at least 10 consecutive trading days within the grace period. In the event the Company does not regain compliance by May 16, 2022, the end of the grace period, the Company may be eligible for an additional 180 calendar day grace period to regain compliance. To qualify for the additional grace period, the Company will be required to meet the continued listing requirement for the market value of its publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second grace period, by effecting the Reverse Split if necessary. However, if it appears to Nasdaq at the end of the grace period that the Company will be unable to cure the deficiency, or if the Company is not otherwise eligible for the additional cure period, Nasdaq will provide notice that the Company’s common stock will be subject to delisting.

While the letter had no immediate impact on the listing of the Company’s common stock, which has continued to be listed and traded on The Nasdaq Capital Market, the Company is seeking stockholder approval of the Reverse Split to enable the Board to take action to attempt to enable the Company to regain compliance with the Nasdaq Rule and continue to be listed on The Nasdaq Capital Market. By including Board discretion to effect the Reverse Split within the range, the Company will be positioned to react to market conditions and actions taken by Nasdaq to increase the Company’s chances of achieving this goal.

The Board has determined that maintaining listing on Nasdaq is an important goal, as the Board believes that the listing of our common stock on a principal national securities exchange enhances the liquidity of the outstanding shares as well as the Company’s ability to raise capital, each of which is considered to be a benefit to the Company and its stockholders. Additionally, the Board believes that continued listing on Nasdaq enhances visibility and credibility to the investment community with respect to our common stock. If, on the other hand, our common stock were delisted from Nasdaq and we were unable to list our securities on an alternative national securities exchange, trading of our common stock would most likely take place on an over-the-counter market established for unlisted securities, such as the OTCQB or a lower-tiered quotation system operated by The OTC Markets Group. In such an event, investors may find it more difficult to sell shares of our common stock. The result could be a depressive effect on our stock price. In addition, if our common stock were delisted, it would become subject to SEC rules regarding “penny stocks,” which impose additional disclosure requirements on broker-dealers and further hindrances and expenses for investors seeking to sell the securities. For these reasons and others, delisting would likely adversely affect the liquidity, trading volume and price of our common stock, causing the value of an investment in us to decrease and having an adverse effect on our business and an investment in us, as well as on our ability to raise capital as and when required.

While the Company hopes that approval of this Proposal 3 will enable it to regain compliance prior to the termination of the grace period, the Company intends to monitor the bid price of its common stock and assess its options for maintaining the listing of its common stock on The Nasdaq Capital Market.

For more information on the risks inherent in the Reverse Split, including with respect to the Nasdaq deficiency notice and potential for delisting, see below under the heading “Certain Risks Associated with the Reverse Split.” For additional information about the risks we and our investors face with respect to our common stock, business and other matters, see “Item 1A. - Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, a copy of which has been mailed with this Proxy Statement to our stockholders of record as of the record date.

| 20 |

Certain Risks Associated with the Reverse Split

If the Reverse Split does not result in a proportionate increase in the price of our common stock, we may be unable to regain compliance with the Nasdaq listing requirements or meet those of another national securities exchange.

We expect that if approved the Reverse Split will increase the market price of our common stock so that we will be able to regain compliance with Nasdaq’s minimum bid price requirement. However, the effect of the Reverse Split on the market price of our common stock cannot be predicted with certainty, and the results of reverse stock splits by companies under similar circumstances have varied. It is possible that the market price of our common stock following the Reverse Split will not increase sufficiently for us to regain compliance with the minimum bid price requirement. For example, if our stock price were to fall below $0.083 per share, the high end of the range of the Reverse Split, which is one-for-12, would potentially be insufficient to enable us to comply with the minimum bid price requirement post-Reverse Split. Further, the Reverse Split may result in a lesser number of round lot holders (holders of at least 100 shares), which could also cause us to be noncompliant with another Nasdaq Rule requiring that we have at least 300 round lot holders. If we are unable meet the minimum bid price requirement or other requirements under Nasdaq Rules, we may not be unable continue to have or common stock listed on Nasdaq, and may be unable to list our common stock on an alternative national securities exchange. This could have a material adverse effect on our liquidity and an investment in us, and impose additional hardships on investors seeking to sell our common stock.

Even if the Reverse Split results in the requisite increase in the market price of our common stock, there is no assurance that we will be able to continue to comply with the minimum bid price requirement.

Even if the Reverse Split results in the requisite increase in the market price of our Common Stock to be in compliance with the minimum bid price requirements of Nasdaq, there can be no assurance that the market price of our common stock following the Reverse Split will remain at the level required for continued compliance with such requirement. It is not uncommon for the market capitalization of a company’s common stock to decline in the period following a reverse stock split. Further, our common stock has been deficient with the Nasdaq minimum bid price requirement numerous times in the past. We have also effected a reverse stock split previously in 2018, which was at a ratio of 1-for-30, which we completed in part to assist with becoming listed on Nasdaq. If the market price of our common stock declines following the implementation of the Reverse Split, the percentage decline may be greater than would occur in the absence of the Reverse Split. In any event, other factors unrelated to the number of shares of our common stock outstanding, such as negative financial or operational results, could adversely affect the market price of our common stock and jeopardize our ability to meet or continue to comply with the minimum bid price requirement.

| 21 |

The Reverse Split may decrease the liquidity of our common stock.

The liquidity of our common stock may be adversely affected by the Reverse Split given the reduced number of shares that will be outstanding following the Reverse Split, especially if the market price of our common stock does not sufficiently increase as a result of the Reverse Split. In addition, the Reverse Split may decrease the number of stockholders who own round lots (less than 100 shares) of our common stock, creating the potential for such stockholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

The increased market price of our common stock resulting from the Reverse Split may not attract new investors, including institutional investors, and may not satisfy the investing guidelines of those investors, and consequently, the liquidity of our common stock may not improve.