THIS NOTE AND THE SHARES OF CAPITAL STOCK ISSUABLE UPON ANY CONVERSION HEREOF HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR ANY APPLICABLE STATE SECURITIES LAWS AND MAY NOT BE SOLD OR OTHERWISE TRANSFERRED TO ANY PERSON, INCLUDING A PLEDGEE, UNLESS (1) EITHER (A) A REGISTRATION STATEMENT WITH RESPECT THERETO SHALL BE EFFECTIVE UNDER THE SECURITIES ACT, OR (B) THE COMPANY SHALL HAVE RECEIVED AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT IS AVAILABLE, AND (2) THERE SHALL HAVE BEEN COMPLIANCE WITH ALL APPLICABLE STATE SECURITIES OR "BLUE SKY" LAWS.

BIOZONE PHARMACEUTICALS, INC.

10% SENIOR SECURED CONVERTIBLE PROMISSORY NOTE

|

Principal Amount: $1,000,000

Purchase Price: $1,000,000

|

|

| |

Issue Date: March 13, 2012

|

BIOZONE PHARMACEUTICALS, INC., a Nevada corporation (the “Company”), for value received, hereby promises to pay to ___________ with an office at ______________________, or his assigns (the “Holder”), one million dollars ($1,000,000) (the “Principal Amount”) in accordance with the amounts and payment schedule set forth on Schedule A attached hereto, together with interest (computed on the basis of a 365-day year for the actual number of days elapsed) from the date hereof on the unpaid balance of such Principal Amount from time to time outstanding at the rate of ten percent (10%) per annum (“Interest”) until paid in full or converted as provided herein.

1. Repayment of the Note. The Principal Amount outstanding hereunder shall be payable in cash in installments in such amounts and on or before such dates specified on Schedule A (the latest such date is referred to as the “Final Maturity Date”). The entire remaining Principal Amount and all accrued but unpaid or unconverted Interest thereof, shall be due and payable on the earliest of (1) the Final Maturity Date, (2) the consummation of a financing by the Company resulting in net proceeds equal to or greater than 1.5 times the remaining outstanding unconverted Principal Amount hereunder and (3) the occurrence of an Event of Default (as defined below).

2. Payment Grace Period. The Borrower shall not have any grace period to pay any monetary amounts due under this Note. After the Final Maturity Date and during the pendency of an Event of Default (as defined below), a default interest rate of fifteen percent (15%) per annum shall be in effect.

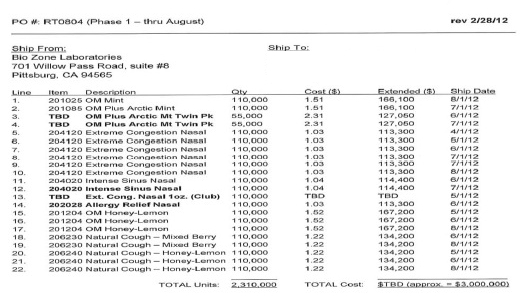

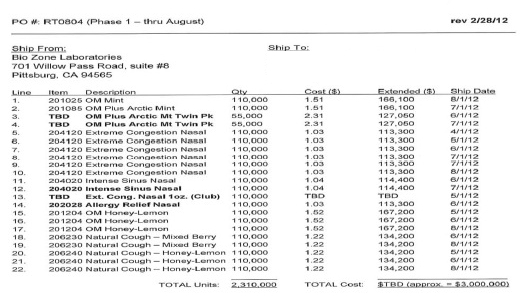

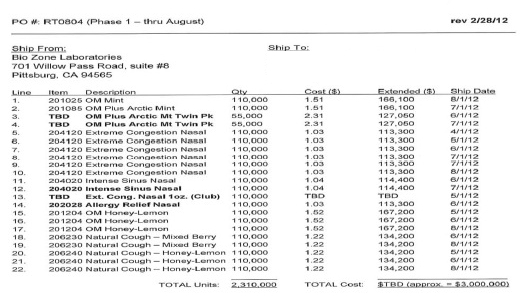

3. Proceeds for Repayment. Schedule B lists certain purchase orders received by the Company from Matrixx Initiatives, Inc. (“Matrixx”) for products to be sold by the Company’s wholly owned subsidiary, BioZone Laboratories Inc. (“BZL”) to Matrixx. The Company agrees to repay the Principal Amount hereunder based on the Company’s receipt of proceeds from sales to Matrixx (the “Matrixx Proceeds”) as and when received in cash, until the unconverted Principal Amount is paid in full, in accordance with the payment schedule set forth on Schedule A. The Company represents and warrants that Schedule B reflects a true list of Purchase Orders received by the Company from Matrixx.

4. Prepayment of the Note. The Company may prepay any outstanding amounts owing under this Note, in whole or in part, at any time prior to the Final Maturity Date.

5. Termination of Rights Under this Note. This Note shall no longer be deemed to be outstanding, and all rights with respect to this Note shall immediately cease and terminate, upon receipt by the Holder of the Principal Amount outstanding and all accrued and unpaid Interest thereon or upon conversion in full of the Principal Amount or Interest then due hereunder pursuant to Section 5 herein or any combination of the foregoing.

6. Optional Conversion of this Note by the Holder.

(a) Optional Conversion. At any time or from time to time and prior to payment in full of the entire Principal Amount, the Holder shall have the right, at the Holder’s option, to convert the Principal Amount and/or accrued but unpaid Interest, in whole or in part (the “Conversion Amount”), into shares of common stock, par value $0.001 per share (the “Common Stock”) of the Company. The number of shares of Common Stock to be issued upon a conversion hereunder shall be determined by dividing the Conversion Amount by $1.50.

(b) Conversion Mechanics. In order to convert this Note into Common Stock, the Holder shall give written notice to the Company at its principal corporate office or the notice address provided in this Note (which notice, notwithstanding anything herein to the contrary, may be given via facsimile, email, or other means in the discretion of the Holder) pursuant to the forms attached hereto as Exhibit C (the “Conversion Notice”) of the election to convert the same pursuant to this section (the date on which a Conversion Notice is given, a “Conversion Date”). Such Conversion Notice shall state the Conversion Amount and the number of shares of Common Stock to which the Holder is entitled pursuant to the Conversion Notice (the “Conversion Shares”). The Company shall immediately, but in no event later than five (5) trading days after receipt of a Conversion Notice (the “Required Delivery Date”), deliver the Conversion Shares to the Holder.

(c) No Fractional Shares. No fractional Conversion Shares shall be issued by the Company. In lieu thereof, the shares of Common Stock otherwise issuable shall be rounded up to the nearest whole Conversion Share.

(d) Holder’s Conversion Limitations. The Company shall not effect any conversion of this Note, and a Holder shall not have the right to convert any portion of this Note, pursuant to Section 5 or otherwise, to the extent that after giving effect to such issuance after conversion as set forth on the applicable Conversion Notice, the Holder (together with the Holder’s affiliates, and any other persons acting as a group together with the Holder or any of the Holder’s affiliates), would beneficially own in excess of the Beneficial Ownership Limitation (as defined below). For purposes of the foregoing sentence, the number of shares of Common Stock beneficially owned by the Holder and its affiliates shall include the number of shares of Common Stock issuable upon conversion of this Note with respect to which such determination is being made, but shall exclude the number of shares of Common Stock which would be issuable upon (i) conversion of the remaining, nonconverted portion of this Note beneficially owned by the Holder or any of its affiliates and (ii) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company (including, without limitation, any other common stock equivalents) subject to a limitation on conversion or exercise analogous to the limitation contained herein beneficially owned by the Holder or any of its affiliates. Except as set forth in the preceding sentence, for purposes of this Section 5(d), beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder, it being acknowledged by the Holder that the Company is not representing to the Holder that such calculation is in compliance with Section 13(d) of the Exchange Act and the Holder is solely responsible for any schedules required to be filed in accordance therewith. To the extent that the limitation contained in this Section 5(d) applies, the determination of whether this Note is convertible (in relation to other securities owned by the Holder together with any affiliates) and of which portion of this Note is convertible shall be in the sole discretion of the Holder, and the submission of an Conversion Notice shall be deemed to be the Holder’s determination of whether this Note is convertible (in relation to other securities owned by the Holder together with any affiliates) and of which portion of this Note is convertible, in each case subject to the Beneficial Ownership Limitation, and the Company shall have no obligation to verify or confirm the accuracy of such determination. In addition, a determination as to any group status as contemplated above shall be determined in accordance with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of this Section 5(d), in determining the number of outstanding shares of Common Stock, a Holder may rely on the number of outstanding shares of Common Stock as reflected in (A) the Company’s most recent periodic or annual report filed with the Commission, as the case may be, (B) a more recent public announcement by the Company or (C) a more recent written notice by the Company or the Company’s transfer agent setting forth the number of shares of Common Stock outstanding. Upon the written or oral request of a Holder, the Company shall within two trading days confirm orally and in writing to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Note, by the Holder or its affiliates since the date as of which such number of outstanding shares of Common Stock was reported. The “Beneficial Ownership Limitation” shall be 4.99% of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock issuable upon conversion of this Note. The Holder, upon not less than 61 days’ prior notice to the Company, may increase or decrease the Beneficial Ownership Limitation provisions of this Section 5(d). Any such increase or decrease will not be effective until the 61st day after such notice is delivered to the Company. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 5(d) to correct this paragraph (or any portion hereof) which may be defective or inconsistent with the intended Beneficial Ownership Limitation herein contained or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitations contained in this paragraph shall apply to a successor holder of this Note.

7. Event of Default. The occurrence of any of the following events of default (“Event of Default”) shall, at the option of the Holder hereof, make the remaining unpaid Principal Amount and all accrued but unpaid Interest immediately due and payable, upon demand, without presentment or grace period, all of which hereby are expressly waived, except as set forth below:

(a) Failure to Pay Principal. The Company fails to pay any installment of principal under this Note when due pursuant to the dates set out on Schedule A.

(b) Breach of Representation and Warranty. Any material representation or warranty of the Company made herein, or in any agreement, statement or certificate given in writing pursuant hereto or in connection therewith shall be false or misleading in any material respect as of the date made and the date of this Note.

(c) Liquidation. Any dissolution, liquidation or winding up of the Company or any Material Subsidiary or any substantial portion of their business taken as a whole. “Material Subsidiary” means, with respect to any entity, which, at any time after the Issue Date and until such time that this Note is fully paid, is a corporation, limited or general partnership, limited liability company, trust, estate, association, joint venture or other business entity of which (A) more than 30% of (i) the outstanding capital stock having ordinary voting power to elect a majority of the board of directors or other managing body of such entity, (ii) in the case of a partnership or limited liability company, the interest in the capital or profits of such partnership or limited liability company or (iii) in the case of a trust, estate, association, joint venture or other entity, the beneficial interest in such trust, estate, association or other entity business is, at the time of determination, owned or controlled directly or indirectly through one or more intermediaries, by the Company, or (B) is under the actual control of the Company.)

(d) Cessation of Operations. Any cessation of operations by the Company.

(e) Maintenance of Assets. The failure by the Company or any Material Subsidiary to maintain any material intellectual property rights, personal, real property or other assets, which are necessary to conduct its business (whether now or in the future).

(f) Receiver or Trustee. The Company or any Material Subsidiary shall make an assignment for the benefit of creditors, or apply for or consent to the appointment of a receiver or trustee for it or for a substantial part of its property or business; or such a receiver or trustee shall otherwise be appointed.

(g) Judgments. Any money judgment, writ or similar final process shall be entered or filed against the Company or any Material Subsidiary or any of its property or other assets for more than $250,000, unless stayed vacated or satisfied within thirty (30) days.

(h) Bankruptcy. Bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings or relief under any bankruptcy law or any law, or the issuance of any notice in relation to such event, for the relief of debtors shall be instituted by or against the Company or any Material Subsidiary.

8. Security Interest. As an inducement for the Holder to extend the loan as evidenced by this Note and to secure the complete and timely payment, performance and discharge in full, as the case may be, of all of the liabilities and obligations (primary, secondary, direct, contingent, sole, joint or several) due or to become due, or that are now or may be hereafter contracted or acquired, or owing to, of the Company to the Holder, the Company hereby unconditionally and irrevocably pledges, grants and hypothecates to the Holder a security interest in and to, a lien upon and a right of set-off against all of their respective right, title and interest of whatsoever kind and nature in and to, the Matrixx Proceeds. The security interest granted herein will terminate upon the payment and performance in full of all such obligations.

9 Non-Waiver. The failure of the Holder to enforce or exercise any right or remedy provided in this Note or at law or in equity upon any default or breach shall not be construed as waiving the rights to enforce or exercise such or any other right or remedy at any later date. No exercise of the rights and powers granted in or held pursuant to this Note by the Holder, and no delays or omission in the exercise of such rights and powers shall be held to exhaust the same or be construed as a waiver thereof, and every such right and power may be exercised at any time and from time to time.

10. Waiver by the Company. The Company hereby waives presentment, protest, notice of protest, notice of nonpayment, notice of dishonor and any and all other notices or demands relative to this Note, except as specifically provided herein.

11. Usury Savings Clause. The Company and the Holder intend to comply at all times with applicable usury laws. If at any time such laws would render usurious any amounts due under this Note under applicable law, then it is the Company’s and Holder’s express intention that the Company not be required to pay Interest on this Note at a rate in excess of the maximum lawful rate, that the provisions of this Section 10 shall control over all other provisions of this Note which may be in apparent conflict hereunder, that such excess amount shall be immediately credited to the balance of the Principal Amount of this Note, and the provisions hereof shall immediately be reformed and the amounts thereafter decreased, so as to comply with the then applicable usury law, but so as to permit the recovery of the fullest amount otherwise due under this Note.

12. Holder Not a Stockholder. The Holder shall not have, solely on account of such status as a holder of this Note, any rights of a stockholder of the Company, either at law or in equity, or any right to any notice of meetings of stockholders or of any other proceedings of the Company until such time as this Note has been converted, at which time the Holder shall be deemed to be the holder of record of the Conversion Shares, as applicable, notwithstanding that the transfer books of the Company shall then be closed or certificates representing such Conversion Shares shall not then have been actually delivered to the Holder

13. Miscellaneous.

(a) Governing Law; Venue. This Note shall be governed by and interpreted in accordance with the Uniform Commercial Code as from time to time in effect in the State of Nevada as to matters within the scope thereof, and, with respect to all other matters, shall be governed by and interpreted in accordance with the laws of the State of Florida, without regard for any conflict of laws. The Company irrevocably consents to the exclusive jurisdiction of any Federal or State court of Florida sitting in Miami-Dade County, Florida in connection with any action or proceeding arising out of or relating to this Note, any document or instrument delivered pursuant to, in connection with or simultaneously with this Note, or a breach of this Note or any such document or instrument.

(b) Successors and Assigns. This Note and the obligations hereunder shall inure to the benefit of and be binding upon the respective successors and assigns of the parties; provided, however, that neither party may assign any of its rights or obligations hereunder without the prior written consent of the other, except that the Holder may assign all or any portion of its rights hereunder to its Affiliate (as such term is defined in Rule 405 of the Securities Act) without such consent by giving written notice of such assignment to the Company. Assignment of all or any portion of this Note in violation of this Section shall be null and void.

(c) Notices. Any notice or other communication required or permitted to be given hereunder shall be in writing. The addresses for such communications shall be: (i) if to the Company to: BioZone Pharmaceuticals, Inc., Attn: Elliot Maza, CEO, facsimile: (201) 608-5103, with a copy to: Sichenzia Ross Friedman Ference LLP, 61 Broadway, New York, NY 10006, Attn: Harvey Kesner, Esq., facsimile: (212) 930-9725; and (ii) if to the Holder, to the name, address and facsimile number set forth on the front page of this Note.

(d) Amendment; Waiver. No modification, amendment or waiver of any provision of this Note shall be effective unless in writing and approved by the Company and the Holder.

(e) Invalidity. Any provision of this Note which may be determined by a court of competent authority to be prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invaliding the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

(f) Section and Paragraph Headings. The section and paragraph headings contained herein are for convenience only and shall not be construed as part of this Note.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK.

SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, this Note has been executed and delivered on the date first above written by the duly authorized representative of the Company.

BIOZONE PHARMACEUTICALS, INC.

By: ________________________________

Name: ______________________________

Title: _______________________________

EXHIBIT A

|

Payment #

|

Payment Date

|

Amount

|

|

1

|

May 7, 2012

|

$ 113,300

|

|

2

|

May 7, 2012

|

$ 113,300

|

|

3

|

June 7, 2012

|

$ 113,300

|

|

4

|

June 7, 2012

|

$ 113,300

|

|

5

|

June 7, 2012

|

$ 113,300

|

|

6

|

July 7, 2012

|

$ 167,200

|

|

7

|

July 7, 2012

|

$ 167,200

|

|

8

|

July 7, 2012

|

$ 99,100

|

|

Total

|

|

$ 1,000,000

|

Exhibit B

EXHIBIT C

Date: ______________________

BIOZONE PHARMACEUTICALS, INC.

_______________________

_______________________

Attn:

CONVERSION NOTICE

The above-captioned Holder hereby gives notice to Biozone Pharmaceuticals, Inc., a Nevada corporation (the “Company”), pursuant to that certain Promissory Note made by the Company in favor of the Holder dated March __, 2012 in the principal amount of $_______ by the Company (the “Note”); that the Holder elects to convert the portion of the Note balance set forth below into fully paid and non-assessable shares of Common Stock of the Company as of the date of conversion specified below.

A. Date of conversion: _____________________

B. Conversion #: _____________________

C. Conversion Amount: _____________________

D. Conversion Price: _____________________

E. Conversion Shares: _____________________

F. Remaining Note Balance: _____________________

Please transfer the Conversion Shares to the undersigned at:

Address:

_____________________

_____________________

_____________________

Sincerely,

By: _____________________

Name: _____________________