July 2, 2012

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

|

Attention:

|

Jennifer Riegel

|

|

|

Jeffrey P. Riedler

|

|

Re:

|

Biozone Pharmaceuticals, Inc.

|

|

|

Registration Statement on Form S-1

|

|

|

Filed December 19, 2011

|

|

|

File No. 333-176951

|

Ladies and Gentlemen:

The following responses address the comments of the Staff (the “Staff”) as set forth in its letter dated January 4, 2012 (the “Comment Letter”) relating to the Registration Statement on Form S-1 (the “Registration Statement”) of Biozone Pharmaceuticals, Inc. (“Biozone” or the “Company”) filed on September 21, 2011 and amended on December 19, 2011. The Company is simultaneously filing Amendment No.2 to the Registration Statement (the “Amendment”). On behalf of the Company, we respond as set forth below.

The numbers of the responses in this letter correspond to the numbers of the Staff’s comments as set forth in the Comment Letter.

General

|

|

1.

|

Since you are a reporting company subject to the requirements of the Securities Exchange Act of 1934, you should respond to the comments in this letter that apply to the disclosure included in your Form 10-K or Form 10-Q within ten business days by providing the requested information or by advising us when you will provide the requested response. A few examples of disclosure that is required to be included in your registration statement and your Form 10-K or Form 10-Q include Business section, Risk Factors, Director and Officer disclosure, Beneficial Ownership Table, MD&A and Financial Statements and the notes thereto. Please review the requirements of Forms 10K and 10-Q for a detailed list of the required disclosure as compared to Form S-1.

|

Response:

The Company undertakes to apply all comments in this letter to its disclosure in its reports filed pursuant to the requirements of the Securities Exchange Act of 1934.

|

|

2.

|

You disclose on page 1 and in response to several comments that your pharmaceuticals business does not constitute a material part of your overall business. Accordingly,

|

|

|

·

|

Please provide us with a detailed analysis which supports your belief that your pharmaceutical business is not material to your business; and

|

|

|

·

|

Please revise your disclosure under “Overview” to appropriately disclose information regarding your material portions of your business and limit your disclosure regarding your pharmaceutical business to a brief discussion in your Business section. This Overview section should only briefly discuss the material portions of your business.

|

1

Response:

The Company’s pharmaceutical business, which generally consists of its research and development of proprietary drug delivery technology (“DDT”), does not constitute a material portion of the Company’s overall business. The Company’s DDT research and development activities are in an early stage, having commenced during the year ended December 31, 2011, and have yet to generate a delivery agent that has been tested in combination with any drug in animals or humans under testing standards required by the United States Food and Drug Administration. In addition, over 95% of the Company’s annual revenue for the years ended December 31, 2011 and 2010 and investment in property plant and equipment are related to the Company’s over the counter drug product and cosmetic and beauty product manufacturing business. The Company has revised its disclosure under the “Overview” section of the Amendment to briefly discuss the material portions of its business and has limited its disclosure regarding its pharmaceutical business to a brief discussion in the Business section.

|

|

3.

|

In response to various prior comments, you state that you will file certain agreements as exhibits to your registration statement. Please promptly file each of the following as you are required to file these agreements pursuant to your requirements under the Securities Exchange Act of'1934 as well as pursuant to the requirements under the Securities Act of 1933. The agreements are as follows:

|

|

|

·

|

Prior comment 26: Confidentiality agreements and intellectual property assignment agreements with your employees;

|

|

|

·

|

Prior comment 51: Material lease agreements, including analysis of any lease agreements that are not material;

|

|

|

·

|

Prior comment 63: Agreements with your three contract manufacturing customers;

|

|

|

·

|

Prior comment 110: All loan agreements related to long-term debt; and

|

|

|

·

|

Prior comment 111: Complete copies of Exhibits 10.12-10.15, 10.22 and 10.24.

|

Response:

The Company has filed all confidentiality agreements and intellectual property assignment agreements with its employees, all material lease agreements, all loan agreements related to long term debt and complete copies of Exhibits 10.12-10.15, 10.22 and 10.24. To date, the Company has only entered into one manufacturing agreement, with its largest customer, and generally satisfies customer orders pursuant to individual purchase orders. The Company has filed this manufacturing agreement and a form of purchase order as exhibits to the Amendment.

Our History, page 2

|

|

4.

|

You disclose that you anticipate discontinuing your prior business relating international surf resorts through the sale of your 55% ownership in ISR de Mexico, S. de R.L. de C.V. in consideration for the return and cancellation of approximately 13,948,001 shares of your common stock. Please disclose whether you are currently in negotiations for this transaction and the status. If you have entered into a letter of intent or other similar term sheet or agreement, please disclose all the material terms of such agreement and file a copy of the agreement. Alternatively, provide us with your analysis which supports your determination that such agreement is not required to be filed.

|

Response:

The Company sold its 55% ownership in ISR de Mexico, S. de R.L. de C.V. in consideration for the return and cancellation of approximately 13,948,001 of its common stock.

2

Business

Manufacturing Business, page 21

|

|

5.

|

On page 5, you disclose that the FDA inspected your manufacturing facilities in January 2011 and again in November 2011. The inspections resulted in numerous observations on Form 483, which you are in the process of remediating. As of the date hereof, you have not received any additional correspondence from the FDA regarding these two inspections. The FDA may conclude that your actions are insufficient to meet regulatory standards. If compliance is deemed deficient in any significant way, it could have a material adverse effect on your business. Please expand your disclosure in this section to disclose the facilities and products which are affected by this Form 483 and provide a summary of the observations noted on the Form 483.

|

Response:

The Company has expanded its disclosure in this section to disclose the facilities affected by the Form 483, explain that the Form 483 was not related to a specific product and to provide a summary of the observations noted in the Form 483.

Customers and Marketing, page 26

|

|

6.

|

We are re-issuing prior comment 63. Please expand your disclosure to identify your three contract manufacturing customers. In addition, please expand your disclosure to disclose all the material terms of each agreement, including the obligations of each party, the consideration received and any financial provisions, and the term and termination provisions.

|

Response:

We have expanded our disclosure regarding our contracts in the Amendment. However, we are concurrently filing a Confidential Treatment Request relating to the identities of our manufacturing customers.

Executive Compensation

Summary Compensation fable, page 33

|

|

7.

|

We note your response to prior comment 75 and your disclosure in footnotes (2) and (5). These disclosures do not appear to be consistent with the biographies provided on page 31. Please advise or revise your disclosure.

|

Response:

Brian Keller, the Company’s current President and Chief Scientific Officer, served as Biozone Laboratories’ principal executive officer for the fiscal year ended December 31, 2010. Following the Company’s purchase of the assets and assumption of the liabilities of Aero Pharmaceuticals, Inc., on May 16, 2011, Elliot Maza was appointed as the Company’s Interim Chief Executive Officer, Financial Officer and Secretary.

3

Certain Relationships and Related Transactions, page 35

|

|

8.

|

You disclose that Daniel Fisher, your Executive Vice President, has advanced funds to you (or working capital. You also disclose that you are in dispute with Mr. Fisher as to the balance due. Please file copies of all written agreements or summaries of the oral agreements related to these advanced funds as exhibit(s) pursuant to Item 601 (b)(10)(ii)(A) of Regulation S-K. In addition, please disclose the amount in dispute.

|

Response:

The Company has filed copies of all agreements related to these advanced funds and has disclosed the amount in dispute.

Plan of Distribution, page 40

|

|

9.

|

You disclose that Aero intends to make a pro-rata distribution to holders of the common stock of Aero of record no later than December 31, 2011 of the shares of common stock of the Company held by Aero. Please revise your registration throughout to reflect this distribution.

|

Response:

Aero transferred the 8,345,310 shares of our common stock to the Aero Liquidating Trust in December 2011, which is holding the shares for the benefit of the holders of the common stock of Aero Pharmaceuticals, Inc. of record on December 31, 2011 (the “Aero Record Date Holders”). The Aero Liquidating Trust intends to make a pro-rata distribution to the Aero Record Date Holders of the appropriate number of units in the trust representing the right to receive the appropriate number of whole shares of the Company’s common stock upon the registration of such shares under federal securities laws or at such time that they may be distributed pursuant to an exemption from the registration requirements, subject to the right of the trustee to sell the shares and distribute the proceeds. The Company has informed the Aero Liquidating Trust that it will make a cash payment, in lieu of issuing fractional shares, to the Aero Record Date Holders who would otherwise be entitled to receive fractional shares upon the distribution of the trust units by the Aero Liquidating Trust. Upon the trust’s pro-rata distribution to its shareholders of units in the trust representing the right to receive the appropriate number of whole shares of the Company’s common, the Company will file a post-effective Rule 424(b) prospectus supplement to update the selling shareholder table to reflect this transfer from the trust.

Biozone Pharmaceuticals Inc. Consolidated financial Statements, page F-1

|

|

10.

|

We note your response to prior comment 89 yet we did not see a Statement of Stockholders' Equity for the Nine Months Ended September 30, 2011. Given the significant transactions that occurred during this period, please revise your filing to include this information.

|

Response:

The Amendment includes the financial statements for the year ended December 31, 2011, which includes a Statement of Stockholders’ Equity for the year ended December 31, 2011.

4

Biozone Pharmaceuticals, Inc. Consolidated Balance Sheets, page F-2

|

|

11.

|

We noted that several of the line items in the financial statements for the amounts at December 31, 2010 do not agree with the sum of the historical financial statements of the Biozone Lab Group: Biozone Lab, Equachem and Equalan. Please provide us a reconciliation of the differences and ensure the pro forma information reflects any changes that are required.

|

Response:

The financial statements provided in the Amendment include a reconciliation of the line items in the financial statements for December 31, 2010 to the historical financial statements of BioZone Lab Group. As shown in the reconciliation, the differences relate to (a) elimination of intercompany balances within the historical financial statements, (b) the presentation of BioZone Pharmaceuticals’ financial statements at December 31, 2010, (c) the effect of the reverse merger to the historical financial statements and (d) reclassifications.

Note 1- Business, page F-5

|

|

12.

|

We note your response to prior comment 90. Please tell us why, given the fact that Biozone Pharmaceuticals' shareholders own the majority of the voting rights of the combined company and that the top two management members (the Chairman and Chief Executive Officer/Chief Financial Officer/Secretary) were from Biozone Pharmaceuticals, you believe that BioZone Lab Group is the acquiring company that obtained control of the acquiree. Please reference ASC 805-10-55-1() through ASC 80510-55-15 and tell us why you believe the attributes for BioZone Lab Group are greater than those of Biozone Pharmaceuticals. In addition, please tell us the sales revenue for Aero Pharmaceuticals (Baker Cummins products) for the year ended December 31, 2010 and any subsequent 2011 interim period. You state that 100% of the combined entity's revenues came from I3ioZone Lab Group but Aero Pharmaceuticals was included in Biozone Pharmaceuticals at the time of the acquisition with BioZone Lab Group. If the Baker Cummins skin product line does not generate any revenue, please clarify this in your filing.

|

Response:

ASC 805-10-55-13 states, “The acquirer usually is the combining entity whose relative size (measured in, for example, assets, revenues, or earnings) is significantly larger than that of the other combining entity or entities”.

The Company analyzed the relative size of the companies in order to determine the accounting acquirer. For the year ended December 31, 2010, sales of the BioZone Lab Group aggregated $15.2 million whereas sales of Aero Pharmaceuticals were $331,000 for the same period. BioZone Pharmaceuticals (International Surf prior to the change in name) had no revenues for the same period. In addition, total assets for the BioZone Lab Group were $7.5 million at December 31, 2010, whereas Aero Pharmaceuticals had assets of $963,000 and International Surf had $89,000 in total assets as of that date. The Company’s Chairman and top officers were appointed after the purchase agreement was made, and in contemplation of the merger. In addition, there was a change in voting rights just prior to the acquisitions that also were made in contemplation of the merger taking place. These factors led to the conclusion that the BioZone Lab Group was the acquirer for accounting purposes.

5

|

|

13.

|

We note your response to prior comment 91 and your statement that you believe that the Biozone Lab Group is the accounting acquirer. Please confirm that the Baker Cummins/Aero financial statements have not been included in the December 31, 2010 historical financial statements. In this regard, we note that Aero was acquired by the accounting acquiree (legal acquirer), not the accounting acquirer.

|

Response:

The Baker Cummins/Aero financial statements have not been included in the December 31, 2010 historical financial statements.

|

|

14.

|

Please tell us why the financial statements of Aero are not required to be tiled pursuant to Rule 3-05 of Regulation S-X. Provide your materiality analysis to clarify why the financial statements are not required.

|

Response:

The Company believes that the financial statements of Aero are not required to be filed as they were filed on form 8-K on May 19, 2011 pursuant to Rule 3-05 of Regulation S-X, financial statements of businesses acquired.

|

|

15.

|

We note your response to prior comment 93. Please tell us the individual percentage ownership of Daniel Fisher, Brian Keller, Nian Wu and Christian Oertle for each entity within the BioZone Lab Group and whether any are immediate family members. In addition, please tell us if there is any legally binding agreement to ensure the group of shareholders acts in concert. Lastly, please tell us if any of these individuals held an interest in Aero Pharmaceuticals prior to the acquisition of Aero, and if so, the percentage of ownership interest.

|

Response:

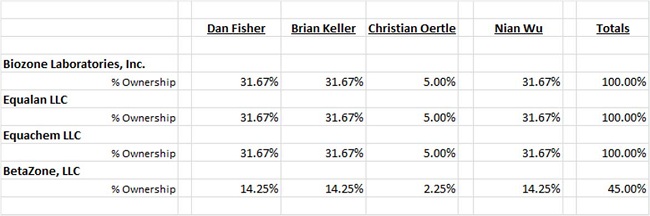

Daniel Fisher, Brian Keller, Nian Wu and Christian Oertle owned the following percentage ownerships in each entity within the BioZone Lab Group immediately prior to the merger:

None of these individuals are related by family relationships and there is no formal or informal agreement to ensure this group of shareholders acts in concert. None of these individuals held an interest in Aero Pharmaceuticals prior to the acquisition of Aero.

6

|

|

16.

|

We note your response to prior comment 94. Please clarify how you determined that BetaZone was an entity under common control. Please tell us what percentage of ownership was held by a Biozone Group shareholder and name that shareholder.

|

Response: The Company determined that BetaZone was an entity under common control because Daniel Fisher, Brian Keller, Christian Oertle and Nian Wu, being all of the BioZone Group shareholders, owned the following percentage ownership in BetaZone immediately prior to the merger:

|

Dan Fisher

|

Brian Keller

|

Christian Oertle

|

Nian Wu

|

Totals

|

|

|

14.25%

|

14.25%

|

2.25%

|

14.25%

|

45.00%

|

Note 3 — Aero Acquisition, page F-7

|

|

17.

|

We note your response to prior comment 95. Please disclose that you have yet to determine the qualitative factors that make up goodwill for the Aero Pharmaceutical acquisition and disclose the timing for when you think the tangible and intangible assets acquired will he identified and valued. Refer to ASC 805-30-50-3.

|

Response:

The Company has revised its disclosure to describe the qualitative factors that make up goodwill for the Aero Pharmaceuticals acquisition and has identified and valued the tangible and intangible assets acquired.

Note 5 — Convertible Notes Payable, page F-8

|

|

18.

|

We note your response to prior comment 97. Please tell us how you determined that the embedded conversion option and warrants are not derivatives pursuant to ASC 815. Consider any anti-dilution features pursuant to ASC 815-40. Please reference any relevant accounting literature and provide an analysis of your accounting for each security. In addition, if you determine that they are embedded derivatives that you cannot separate from the convertible notes, please tell us how you determined that the entire contract did not require fair value accounting due to your inability to reliably measure the embedded derivatives. Refer to ASC 815-15-25-52 and ASC 815-15-25-53.

|

Response:

The Company has reevaluated the warrants issued and has determined that they meet the criteria to be classified as a derivative pursuant to ASC 815. The Company has accounted for the warrants as derivatives, which have been reflected in the financial statements for the year ended December, 31, 2011. The embedded conversion option in connection with our convertible debt could not be exercised unless and until we completed a “Qualifying Financing” transaction, as such term was defined in the notes. Accordingly, we determined based on authoritative guidance that the embedded conversion option is deemed to be a contingent conversion rather than an active conversion option that did not require accounting recognition at the commitment dates of the issuances of the convertible notes.

7

Biozone Laboratories, Inc. Consolidated Financial Statements

Note 2 — Summary of Significant Accounting Policies, page F-17

|

|

19.

|

We note your response to prior comment 98 and your related expanded disclosure regarding 580 Garcia Properties, LLC. As previously requested, please provide us your analysis as to how you determined that 580 Garcia Properties, LLC was a variable interest entity requiring consolidation. Refer to ASC 810-10-25. Ensure that your analysis addresses the percentage of the fair value of the asset for which you guarantee (the 20,000 square foot cGMP facility) to the total fair value amount of the assets in 580 Garcia Properties, LLC. Refer to ASC 810-10-25-55 through 810-10-25-56.

|

Response:

580 Garcia Properties, LLC is the legal owner of the property located at 580 Garcia Avenue, Pittsburg, California, which is used by BioZone Laboratories for offices and factory operations. The Company has concluded that 580 Garcia Properties, LLC should be considered a variable interest entity of the Company based on the following factors:

|

|

·

|

The members of 580 Garcia Properties, LLC are Daniel Fisher and Sharon Fisher, who collectively owned 32% of BioZone Laboratories of the BioZone Labs Group prior to the merger with the BioZone Pharmaceuticals, Inc.

|

|

|

·

|

BioZone Laboratories is the sole tenant of the property and has guaranteed 100% of the mortgage on the property. The mortgage balance is approximately $2,378,000, which constitutes 182% of the property’s current fair market value of $1,300,000

|

|

|

·

|

The lease between BioZone Laboratories and 580 Garcia Properties, LLC provides for monthly rental equal to the amount of the mortgage payment plus an additional amount

|

|

|

·

|

580 Garcia Properties, LLC’s only asset is the building and it lacks the resources to finance the property without subordination or support from the Company.

|

Equalan Pharma, LLC Consolidated Financial Statements

Note 4 — Related Parties, page F-32

|

|

20.

|

We note your response to prior comment 99. Please revise your disclosure to clarify that the trade receivables from a company under common ownership are due to a direct loan and not sales.

|

Response:

The Company has revised its disclosure to clarify that the trade receivables from a company under common ownership are due to a direct loan and not sales.

Pro Forma Financial Information, page F-41

|

|

21.

|

In your response to prior comment 105 you noted that the company presented pro forma statement of operations for the period ended September 30, 2011 yet the pro forma information beginning on page F-41 is as of March 31, 2011. The information should be as of the most recent interim period, September 30, 2011. In addition, the pro forma Statement of Operations should also show the pro forma information as of the most recent fiscal year end, December 31, 2010. Please revise your filing accordingly.

|

Response:

The financial statements for September 30, 2011 are shown on a consolidated basis post acquisition. The Company understands a pro forma to reflect a transaction that has happened after a specific date to show what the historical financial statement would have looked like if the transaction had happened as of the date of the historical financials. Because the September 30, 2011 financials are consolidated, the Company did not consider filing pro forma statements as the end result would have been the same as the consolidated financial statements. The Company filed the pro forma statements for December 31, 2010 to reflect what the acquisition would have reflected if it had happened as of that period. The Company filed the pro forma statement of operations for March 31, 2011 to comply with the SEC’s previous comment 105.

8

Item 15. Recent Sales of Unregistered Securities, page 11-2

|

|

22.

|

We note your response to prior comment 106. Please promptly file your Form D for your unregistered offering completed on March 29, 2011 for the issuance of 10% secured convertible promissory notes in the aggregate principal amount of $2,250,000. See Guidance on Form D Filing Process located at http://www.sec.f.4ovidivisions/corplinliormdfilina.htm.

|

Response:

The Company filed a Form D for this unregistered offering completed on April 26, 2012.

Exhibit 5.1

|

|

23.

|

We are re-issuing prior comment 112. Please file a revised opinion that removes the statement “and will be, when issued in the manner described in the Registration Statement” from this opinion.

|

Response:

The Company has filed a revised opinion that removes the statement “and will be, when issued in the manner described in the Registration Statement” from this opinion.

***

The Company hereby acknowledges the following:

|

|

·

|

The Company is responsible for the adequacy and accuracy of the disclosures in the filings;

|

|

|

·

|

Staff comments or changes to disclosures in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and

|

|

|

·

|

The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

Please do not hesitate to contact the undersigned at 201-608-5101 if you have any questions or comments. Thank you.

Very truly yours,

/s/ Elliot Maza

Elliot Maza

Cc: Harvey Kesner, Esq.

Sichenzia Ross Friedman Ference LLP