UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification No.) | |

| (Address of Principal Executive Office) | (Zip Code) |

Registrant’s telephone number, including area

code:

Indicate by check mark whether the registrant: (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Sec.232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a

shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

|

The (The Nasdaq Capital Market) |

As of May 15, 2025, the number of outstanding shares of the registrant’s common stock, par value $ per share, was approximately .

COCRYSTAL PHARMA, INC.

FORM 10-Q FOR THE QUARTER ENDED MARCH 31, 2025

INDEX

| 2 |

Part I – FINANCIAL INFORMATION

COCRYSTAL PHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

| March 31, 2025 | December 31, 2024 | |||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | $ | ||||||

| Restricted cash | ||||||||

| Tax credit receivable | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Deposits | ||||||||

| Operating lease right-of-use assets, net (including $ | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and stockholders’ equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Current maturities of operating lease liabilities (including $ | ||||||||

| Total current liabilities | ||||||||

| Long-term liabilities: | ||||||||

| Operating lease liabilities (including $ | ||||||||

| Total long-term liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Common stock, $ a par value: shares authorized as of March 31, 2025 and December 31, 2024; shares issued and outstanding as of March 31, 2025 and December 31, 2024 | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Total stockholders’ equity | ||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

| F-1 |

COCRYSTAL PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except per share data)

| Three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Operating expenses: | ||||||||

| Research and development | ||||||||

| General and administrative | ||||||||

| Total operating expenses | ||||||||

| Loss from operations | ( | ) | ( | ) | ||||

| Other income (expense): | ||||||||

| Interest income (expense), net | ||||||||

| Foreign exchange gain (loss), net | ( | ) | ||||||

| Total other income (expense), net | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Net loss per common share, basic and diluted | $ | ) | $ | ) | ||||

| Weighted average number of common shares, basic and diluted | ||||||||

See accompanying notes to condensed consolidated financial statements.

| F-2 |

COCRYSTAL PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the three months ended March 31, 2025 and 2024

(unaudited)

(in thousands)

| Common Stock | Additional Paid-in | Accumulated | Total Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance as of December 31, 2024 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||

| Balance as of March 31, 2025 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Common Stock | Additional Paid-in | Accumulated | Total Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | ( | ) | $ | ||||||||||||||

| Stock-based compensation | - | |||||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||

| Balance as of March 31, 2024 | $ | $ | $ | ( | ) | $ | ||||||||||||||

See accompanying notes to condensed consolidated financial statements.

| F-3 |

COCRYSTAL PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

| Three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation and amortization expense | ||||||||

| Stock-based compensation | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Tax credit receivable | ( | ) | ( | ) | ||||

| Deposits | ( | ) | ||||||

| Decrease right of use assets | ||||||||

| Accounts payable and accrued expenses | ( | ) | ( | ) | ||||

| Decrease operating lease liabilities | ( | ) | ( | ) | ||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Investing activities: | ||||||||

| Purchases of property and equipment | ( | ) | ||||||

| Net cash used in investing activities | ( | ) | ||||||

| Net decrease in cash and restricted cash | ( | ) | ( | ) | ||||

| Cash and restricted cash at beginning of period | ||||||||

| Cash and restricted cash at end of period | $ | $ | ||||||

See accompanying notes to condensed consolidated financial statements.

| F-4 |

COCRYSTAL PHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND 2024

(unaudited)

1. Organization and Business

Cocrystal Pharma, Inc. (“we”, the “Company” or “Cocrystal”), a clinical stage biopharmaceutical company incorporated in Delaware, has been developing novel technologies and approaches to create first-in-class or best-in-class antiviral drug candidates. Our focus is to pursue the development and commercialization of broad-spectrum antiviral drug candidates that will transform the treatment and prophylaxis of viral diseases in humans. By concentrating our research and development efforts on viral replication inhibitors, we plan to leverage our infrastructure and expertise in these areas.

The Company’s activities since inception have principally consisted of acquiring product and technology rights, raising capital, and performing research and development. Successful completion of the Company’s development programs, obtaining regulatory approvals of its products and, ultimately, the attainment of profitable operations is dependent on future events, including, among other things, its ability to access potential markets, secure financing, develop a customer base, attract, retain and motivate qualified personnel, and develop strategic alliances.

Liquidity and going concern

The Company’s consolidated financial

statements are prepared using generally accepted accounting principles in the United States of America applicable to a going

concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The

Company has incurred net losses and negative operating cash flows since inception. For the three months ended March 31, 2025, the

Company recorded a net loss of approximately $

On March 31, 2025, the Company had cash and restricted

cash of approximately $

The Company’s activities since inception have principally consisted of acquiring product and technology rights, raising capital, and performing research and development. Successful completion of the Company’s development programs, obtaining regulatory approvals of its products and, ultimately, the attainment of profitable operations is dependent on future events, including, among other things, its ability to access potential markets, secure financing, develop a customer base, attract, retain and motivate qualified personnel, and develop strategic alliances. Through March 31, 2025, the Company has primarily funded its operations through equity offerings.

The Company will need to continue obtaining adequate capital to fund operating losses until it becomes profitable. The Company can give no assurances that the additional capital it is able to raise, if any, will be sufficient to meet its needs, or that any such financing will be obtainable on acceptable terms. Our future cash requirements, and the timing of those requirements, will depend on a number of factors, including economic conditions, the approval and success of our products in development, the continued progress of research and development of our product candidates, the timing and outcome of clinical trials and regulatory approvals, the costs involved in preparing, filing, prosecuting, maintaining, defending, and enforcing patent claims and other intellectual property rights, the status of competitive products, the availability of financing, our success in developing markets for our product candidates and legal proceedings that may arise. We have historically not generated sustained positive cash flow and if we are not able to secure additional funding when needed, we may have to delay, reduce the scope of, or eliminate one or more of our clinical trials or research and development programs. If the Company is unable to obtain adequate capital, it could be forced to cease operations or substantially curtail its drug development activities. The Company expects to continue incurring substantial operating losses and negative cash flows from operations over the next several years during its pre-clinical and clinical development phases.

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”) for interim financial information, the instructions to Form 10-Q and Article 10 of Regulation S-X set forth by the Securities and Exchange Commission (“SEC”). They do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. The results of operations for the interim periods presented are not necessarily indicative of the results of operations for the entire fiscal year. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2024 filed on March 31, 2025 (“Annual Report”).

Principles of Consolidation

The consolidated financial statements include the accounts of Cocrystal Pharma, Inc. and its wholly owned subsidiaries: Cocrystal Discovery, Inc., Cocrystal Pharma Australia Pty Ltd. (“Cocrystal Australia”), RFS Pharma, LLC and Cocrystal Merger Sub, Inc. Intercompany transactions and balances have been eliminated. Cocrystal Discovery, Inc. conducts all of the Company’s research and development activities and oversees ongoing clinical trials conducted by others. Cocrystal Australia operates clinical trials in Australia. The other two subsidiaries are inactive.

Segments

The Company’s Co-Chief Executive Officer and President (“CEO”) is our chief operating decision maker (“CODM”) and evaluates performance and makes operating decisions about allocating resources based on financial data presented on a consolidated basis. Because our CODM evaluates financial performance on a consolidated basis, the Company has determined that it operates as a single reportable segment composed of the consolidated financial results of Cocrystal Pharma, Inc. The measure of segment assets is reported on the consolidated balance sheets as total assets (see Note 9).

| F-5 |

Use of Estimates

Preparation of the Company’s consolidated financial statements in conformance with U.S. GAAP requires the Company’s management to make estimates and assumptions that impact the reported amounts of assets, liabilities, revenues and expenses, and the disclosure of contingent assets and liabilities in the Company’s consolidated financial statements and accompanying notes.

The most significant estimates in the Company’s consolidated financial statements relate to clinical trial costs and accruals and the fair value of stock-based compensation. The Company bases estimates and assumptions on historical experience, when available, and on various factors that it believes to be reasonable under the circumstances. The Company evaluates its estimates and assumptions on an ongoing basis, and its actual results may differ from estimates made under different assumptions or conditions.

Concentrations of Credit Risk

Financial instruments that potentially subject the

Company to significant concentrations of credit risk consist primarily of cash deposited in accounts held at two U.S. financial institutions,

which may, at times, exceed federally insured limits of $

Risks and uncertainties

The Company’s future results of operations involve a number of risks and uncertainties. Factors that could affect the Company’s future operating results and cause actual results to vary materially from expectations include, but are not limited to, rapid technological change, ability to obtain regulatory approvals, competition from currently available treatments and therapies, competition from larger companies, effective protection of proprietary technology, maintenance of strategic relationships, and dependence on key individuals.

Products developed by the Company will require clearances from the U.S. Food and Drug Administration (the “FDA”) and other international regulatory agencies prior to commercial sales in their respective markets. The Company’s products may not receive the necessary clearances and if they are denied clearance, clearance is delayed, or the Company is unable to maintain clearance, the Company’s business could be materially, adversely impacted.

See Item 1A- Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2024 for more information on the risks and uncertainties we face.

Foreign Currency Transactions

The Company and its subsidiaries use the U.S. dollar as functional currency. Foreign currency transactions are initially measured and recorded in the functional currency using the exchange rate on the date of the transaction. Foreign exchange gains and losses arising from settlement of foreign currency transactions are recognized in profit and loss.

Cocrystal Australia maintains its records in Australian dollars. The monetary assets and liabilities of Cocrystal Australia are remeasured into the functional currency using the closing rate at the end of every reporting period. All nonmonetary assets and liabilities and related profit and loss accounts are remeasured into the functional currency using the historical exchange rates. Profit and loss accounts, other than those that are remeasured using the historical exchange rates, are remeasured into the functional currency using the average exchange rate for the period. Foreign exchange gains and losses arising from the remeasurement into the functional currency is recognized in profit and loss.

Fair Value Measurements

FASB Accounting Standards Codification (“ASC”) 820 defines fair value, establishes a framework for measuring fair value under U.S. GAAP and enhances disclosures about fair value measurements. Fair value is defined under ASC 820 as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value under ASC 820 must maximize the use of observable inputs and minimize the use of unobservable inputs. The standard describes a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value which are the following:

| Level 1 — quoted prices in active markets for identical assets or liabilities. |

| F-6 |

| Level 2 — other significant observable inputs for the assets or liabilities through corroboration with market data at the measurement date. | |

| Level 3 — significant unobservable inputs that reflect management’s best estimate of what market participants would use to price the assets or liabilities at the measurement date. |

At March 31, 2025 and December 31, 2024, the carrying amounts of financial assets and liabilities, such as cash, tax receivable, other assets, and accounts payable and accrued expenses approximate their fair values due to their short-term nature. The carrying values of leases payable approximate their fair values due to the fact that the interest rates on these obligations are based on prevailing market interest rates.

Long-Lived Assets

The Company regularly reviews the carrying value and estimated lives of its long-lived assets, including property and equipment, to determine whether indicators of impairment may exist which warrant adjustments to carrying values or estimated useful lives. The determinants used for this evaluation include management’s estimate of the asset’s ability to generate positive income from operations and positive cash flow in future periods as well as the strategic significance of the assets to the Company’s business objective. Should an impairment exist, the impairment loss would be measured based on the excess of the carrying amount over the asset’s fair value.

Research and Development Expenses

Research and development costs consist primarily of fees paid to consultants and outside service providers, and other expenses relating to the acquisition, design, development and testing of the Company’s clinical products. All research and development costs are expensed as incurred. Research and development costs are presented net of tax credits.

The Company’s Australian subsidiary is entitled

to receive government assistance in the form of refundable and non-refundable research and development tax credits (“Refundable

Tax Credits”) from the federal and provincial taxation authorities, based on qualifying expenditures incurred during the fiscal

year. The Refundable Tax Credits are from the provincial taxation authorities and are not dependent on its ongoing tax status or tax position

and accordingly are not considered part of income taxes. The Company records Refundable Tax Credits as a reduction of research and development

expenses when the Company can reasonably estimate the amounts and it is more likely than not, they will be received. As of December 31,

2024, balance of Refundable Tax Credits was approximately $

Income Taxes

The Company accounts for income taxes under the asset and liability method. Under this method, deferred tax assets and liabilities are determined based on differences between financial reporting and tax bases of assets and liabilities and are measured using enacted tax rates and laws that are expected to be in effect when the differences are expected to be recovered or settled. Realization of deferred tax assets is dependent upon future taxable income. A valuation allowance is recognized if it is more likely than not that some portion or all of a deferred tax asset will not be realized based on the weight of available evidence, including expected future earnings. The Company recognizes an uncertain tax position in its financial statements when it concludes that a tax position is more likely than not to be sustained upon examination based solely on its technical merits. Only after a tax position passes the first step of recognition will measurement be required. Under the measurement step, the tax benefit is measured as the largest amount of benefit that is more likely than not to be realized upon effective settlement. This is determined on a cumulative probability basis. The full impact of any change in recognition or measurement is reflected in the period in which such change occurs. The Company elects to accrue any interest or penalties related to income taxes as part of its income tax expense.

| F-7 |

As of March 31, 2025, the Company assessed its income tax expense based on its projected future taxable income for the year ending December 31, 2025 and therefore recorded no amount for income tax expense for the three months ended March 31, 2025. In addition, the Company has significant deferred tax assets available to offset income tax expense due to net operating loss carry forwards which are currently subject to a full valuation allowance based on the Company’s assessment of future taxable income. Refer to our Annual Report on Form 10-K for the year ended December 31, 2024 for more information.

The Company recognizes compensation expense using a fair value-based method for costs related to stock-based payments, including stock options. The fair value of options awarded to employees is measured on the date of grant using the Black-Scholes option pricing model and is recognized as expense over the requisite service period on a straight-line basis. Recognition of compensation expense for non-employees is in the same period and manner as if the Company had paid cash for the services.

Use of the Black-Scholes option pricing model requires the input of subjective assumptions including expected volatility, expected term, and a risk-free interest rate. The Company estimates volatility using a blend of its own historical stock price volatility as well as that of market comparable entities since the Company’s common stock has limited trading history and limited observable volatility of its own. The expected term of the options is estimated by using the SEC Staff Bulletin No. 107’s Simplified Method for Estimate Expected Term. The risk-free interest rate is estimated using comparable published federal funds rates.

The Company accounts for and discloses net income (loss) per common share in accordance with FASB ASC Topic 260, Earnings Per Share. Basic income (loss) per common share is computed by dividing income (loss) attributable to common stockholders by the weighted average number of common shares outstanding. Diluted net income (loss) per common share is computed by dividing net income (loss) attributable to common stockholders by the weighted average number of common shares that would have been outstanding during the period assuming the issuance of common stock for all potential dilutive common shares outstanding. Potential common shares consist of shares issuable upon the exercise of stock options and restricted stock units.

| March 31, | ||||||||

| 2025 | 2024 | |||||||

| Outstanding options to purchase common stock | ||||||||

| Unvested restricted stock units | ||||||||

| Total | ||||||||

Recent Accounting Pronouncements

In November 2024, the Financial Accounting Standards Board (FASB) issued ASU No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses which includes amendments that require disclosure in the notes to financial statements of specified information about certain costs and expenses, including purchases of inventory; employee compensation; and depreciation, amortization and depletion expenses for each caption on the income statement where such expenses are included. The amendments are effective for the Company’s annual periods beginning January 1, 2027, with early adoption permitted, and should be applied either prospectively or retrospectively. The Company is in the process of evaluating this ASU to determine its impact on the Company’s disclosures.

Other authoritative guidance issued by the FASB (including technical corrections to the ASC), the American Institute of Certified Public Accountants, and the SEC did not, or are not expected to, have a material impact on the Company’s consolidated financial statements and related disclosures.

| F-8 |

3. Property and Equipment

Property and equipment are recorded at cost and depreciated over the estimated useful lives of the underlying assets (three to five years) using the straight-line method. As of March 31, 2025, and December 31, 2024, property and equipment consists of (table in thousands):

| March 31, 2025 | December 31, 2024 | |||||||

| Lab equipment (excluding equipment under finance leases) | $ | $ | ||||||

| Finance lease right-of-use lab equipment obtained in exchange for finance lease liabilities, net | ||||||||

| Computer and office equipment | ||||||||

| Total property and equipment | ||||||||

| Less: accumulated depreciation and amortization | ( | ) | ( | ) | ||||

| Property and equipment, net | $ | $ | ||||||

Total depreciation and amortization expense were

approximately $

4. Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses consisted of the following (in thousands) as of:

| March 31, 2025 | December 31, 2024 | |||||||

| Accounts payable | $ | $ | ||||||

| Accrued compensation | ||||||||

| Accrued other expenses | ||||||||

| Total accounts payable and accrued expenses | $ | $ | ||||||

Accounts payable and accrued expenses contain unpaid general and administrative expenses and costs related to research and development that have been billed and estimated unbilled, respectively, as of period-end.

5. Common Stock

On June 27, 2024, the Company, following approval

of the Company’s stockholders at the 2024 Annual Meeting of Stockholders filed an amendment to its Certificate of Incorporation

with the Secretary of State of the State of Delaware (the “Amendment”) to decrease the number of shares of authorized capital

stock of the Company from

As of March 31, 2025, the Company has authorized shares of common stock, $ par value per share. The Company had and shares issued and outstanding as of March 31, 2025, and December 31, 2024.

The holders of common stock are entitled to one vote for each share of common stock held.

Equity Incentive Plans

The Company adopted an equity incentive plan in 2015 (the “2015 Plan”) under which shares of common stock have been reserved for issuance to employees, and non-employee directors and consultants of the Company. Recipients of incentive stock options granted under the 2015 Plan shall be eligible to purchase shares of the Company’s common stock at an exercise price equal to no less than the estimated fair market value of such stock on the date of grant. The maximum term of options granted under the 2015 Plan is . On June 16, 2021, the Company’s stockholders voted to approve an amendment to the 2015 Plan to increase the number of shares of common stock authorized for issuance under the 2015 Plan from to shares. As of March 31, 2025, shares remain available for future grants under the 2015 Plan. The 2015 Plan expires on June 29, 2025.

| F-9 |

On April 2, 2025, our board of directors approved an Equity Incentive Plan (the “2025 Plan”) that remains subject to shareholder approval and ratification. The 2025 Plan provides for the grant of incentive stock options, qualified stock options, restricted stock awards, restricted stock units, stock appreciation rights, and performance shares or units and cash awards. Awards may be granted under the 2025 Plan to our employees, directors and independent contractors. the aggregate number of shares of Common Stock which shall be available for grants or payments of Awards under the 2025 Plan during its term shall initially be (the “Total Plan Shares”). The Total Plan Shares will automatically increase on January 1st of each year, for a period of nine years commencing on January 1, 2026, in an amount equal to % of the total number of shares of Common Stock outstanding as of December 31 of the preceding calendar year on a fully diluted basis.

The 2025 Plan also provides that, notwithstanding the annual increase provision, in no event will the increase in Total Plan Shares available under the 2025 Plan pursuant to the increase provision exceed additional shares (or a total of up to Total Plan Shares), subject to adjustment as provided under the 2025 Plan. The 2025 Plan is effective as of March 31, 2025; however, the 2025 Plan is subject to approval of our stockholders which the Company is seeking at its annual meeting of stockholders scheduled for June 25, 2025.

Common Stock Reserved for Future Issuance

The following table presents information concerning common stock available for future issuance (in thousands) as of March 31, 2025:

| Shares Available for Grant | ||||

| Balance at December 31, 2024 | ||||

| Cancelled or forfeited | ||||

| Balance at March 31, 2025 | $ | |||

Stock Options

| Total Options Outstanding | Weighted Average Exercise Price | Aggregate Intrinsic Value | ||||||||||

| Balance at December 31, 2024 | $ | $ | ||||||||||

| Exercised | ||||||||||||

| Granted | ||||||||||||

| Cancelled | ( | ) | ||||||||||

| Balance at March 31, 2025 | $ | $ | ||||||||||

Restricted Stock Units

On August 12, 2024, the Company’s Compensation Committee approved the issuance of restricted stock unit (“RSU”) awards to non-employee directors, officers, consultants and employees. The aggregate fair value of the restricted stock unit awards granted was estimated to be $ using the market price of the stock on the date of the grant which is expensed using the straight-line method over the vesting period.

| Total Restricted Stock Units Outstanding |

Weighted Average Fair Value |

Aggregate Intrinsic Value |

||||||||||

| Unvested December 31, 2024 | $ | $ | ||||||||||

| Granted | ||||||||||||

| Forfeited | ( |

|||||||||||

| Vested | ||||||||||||

| Unvested and expected to vest at March 31, 2025 |

|

$ | $ | |||||||||

| F-10 |

The Company accounts for share-based awards to employees and nonemployee directors and consultants in accordance with the provisions of ASC 718, Compensation—Stock Compensation., and under the recently issued guidance following FASB’s pronouncement, ASU 2018-07, Compensation—Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. Under ASC 718, and applicable updates adopted, share-based awards are valued at fair value on the date of grant and that fair value is recognized over the requisite service, or vesting, period. The Company values its equity awards using the Black-Scholes option pricing model, and accounts for forfeitures when they occur. For the three months ended March 31, 2025 and 2024, equity-based compensation expense recorded was approximately $ and $, respectively.

As of March 31, 2025, there was approximately $ of total unrecognized compensation expense related to non-vested stock options that is expected to be recognized over a weighted average period of years. For options granted and outstanding, there were options outstanding which were fully vested or expected to vest, with an aggregate intrinsic value of $ , a weighted average exercise price of $ and weighted average remaining contractual term of years at March 31, 2025. For vested and exercisable options, outstanding shares totaled , with an aggregate intrinsic value of $ . These options had a weighted average exercise price of $ per share and a weighted-average remaining contractual term of years at March 31, 2025.

The aggregate intrinsic value of outstanding and exercisable options at March 31, 2025 was calculated based on the closing price of the Company’s common stock as reported on The Nasdaq Capital Market on March 31, 2025 of $ per share less the exercise price of the options. The aggregate intrinsic value is calculated based on the positive difference between the closing fair market value of the Company’s common stock and the exercise price of the underlying options.

7. Commitments and Contingencies

Commitments

In the ordinary course of business, the Company enters into non-cancellable leases to purchase equipment and for its facilities, including related party leases (see Note 8 – Transactions with Related Parties). Leases are accounted for as operating leases or finance leases, in accordance with ASC 842, Leases.

Operating Leases

The Company leases office space in Miami, Florida and research and development

laboratory space in Bothell, Washington under operating leases that expire on September 30, 2027 and January 31, 2031, respectively. For operating leases, the weighted average discount rate is

The following table summarizes the Company’s maturities of operating lease liabilities, by year and in aggregate, as of March 31, 2025 (table in thousands):

| 2025 (excluding the three months ended March 31, 2025) | $ | |||

| 2026 | ||||

| 2027 | ||||

| 2028 | ||||

| 2029 | ||||

| 2030 and thereafter | ||||

| Total operating lease payments | ||||

| Less: present value discount | ( | ) | ||

| Total operating lease liabilities | $ |

As of March 31, 2025, the total operating lease liability

of $

In April 2023, the Company renewed

its lease for the unit 100 at the Bothel, Washington facility (“Bothel 100”) for an 84-month (7 years) term, starting February

1, 2024, and ending on January 31, 2031. The Company classified the amended lease as an operating lease pursuant to the provisions of

ASC 842 and calculated the discounted value of the total lease payments to be approximately $

In September 2023, following

the renewal of the Bothell 100 facility lease, the Company amended the agreement to expand the premises to include Suite 200 (“Bothell

200 facility”). The lease for the Bothell 200 facility has a 60-month (5-year) term, running from February 1, 2024, through January

31, 2029. The Company classified the lease as an operating lease and calculated the discounted value of the total lease payments to be

approximately $

In August 2024, the Company renewed its lease for

the Miami, Florida location for a 36-month term, starting from October 1, 2024, and ending on September 30, 2027, with an optional two-year

extension. At the time of renewal, the Company classified the lease as an operating lease pursuant to the provisions of ASC 842 and calculated

the discounted value of the total lease payments to be approximately $

The operating lease liabilities summarized above do

not include variable common area maintenance (the “CAM”) charges, which are contractual liabilities under the Company’s

Bothell, Washington lease. CAM charges for the Bothell, Washington facility are calculated annually based on actual common expenses for

the building incurred by the lessor and proportionately billed to tenants based on leased square footage. For the three months ended March

31, 2025 and 2024, approximately $

The lessor of the Miami, Florida lease is a limited liability company controlled by Dr. Phillip Frost, a director and a principal stockholder of the Company.

| F-11 |

For the three months ended March 31, 2025 and 2024,

operating lease expense, excluding short-term leases, finance leases and CAM charges, totaled approximately $

Phase 2a Clinical Trial

On August 3, 2022 the Company engaged hVIVO, a

subsidiary of London-based Open Orphan plc (AIM: ORPH), a rapidly growing specialist contract research organization

(“CRO”), to conduct a Phase 2a clinical trial with the Company’s novel, broad-spectrum, orally administered

antiviral influenza candidate. The Company prepaid a reservation fee of $

The total estimated cost of the agreement (including

the reservation fee) is approximately $

Contingencies

From time to time, the Company is a party to, or otherwise involved in, legal proceedings arising in the normal course of business. As of the date of this report, except as described below, the Company is not aware of any proceedings, threatened or pending, against it which, if determined adversely, would have a material effect on its business, results of operations, cash flows or financial position.

8. Transactions with Related Parties

On August 14, 2024, the Company entered into a three-year lease extension

with a limited liability company controlled by Dr. Phillip Frost, a director and a principal stockholder of the Company. On an annualized

basis, straight-line rent expense is approximately $

The Company paid a lease deposit of $

9. Segment Information

The Company operates and manages its business as one reportable and operating segment dedicated to the research and development Company’s novel orally administered antiviral influenza candidate. The measure of segment assets is reported on the balance sheet as total consolidated assets. In addition, the Company manages the business activities on a consolidated basis.

The Company’s CODM reviews financial information presented on a consolidated basis and decides how to allocate resources based on net income (loss).

Significant segment expenses include research and development, salaries, insurance, and stock-based compensation. Operating expenses include all remaining costs necessary to operate our business, which primarily include external professional services and other administrative expenses. The following table presents the significant segment expenses and other segment items regularly reviewed by our CODM (table in thousands):

| Three months ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Revenue | $ | $ | ||||||

| Less: | ||||||||

| Research and development | ||||||||

| Salaries and personnel costs | ||||||||

| Insurance | ||||||||

| Stock-based compensation | ||||||||

| Operating expenses | ||||||||

| Other income | ( | ) | ( | ) | ||||

| Net loss | $ | $ | ||||||

10. Subsequent Events

On April 2, 2025, our board of directors approved an Equity Incentive Plan (the “2025 Plan) that remains subject to shareholder approval and ratification. The 2025 Plan provides for the grant of incentive stock options, qualified stock options, restricted stock awards, restricted stock units, stock appreciation rights, and performance shares or units and cash awards. Awards may be granted under the 2025 Plan to our employees, directors and independent contractors. the aggregate number of shares of Common Stock which shall be available for grants or payments of Awards under the 2025 Plan during its term shall initially be (the “Total Plan Shares”). The Total Plan Shares will automatically increase on January 1st of each year, for a period of nine years commencing on January 1, 2026, in an amount equal to % of the total number of shares of Common Stock outstanding as of December 31 of the preceding calendar year on a fully diluted basis. The 2025 Plan also provides that, notwithstanding the annual increase provision, in no event will the increase in Total Plan Shares available under the 2025 Plan pursuant to the increase provision exceed additional shares (or a total of up to Total Plan Shares), subject to adjustment as provided under the 2025 Plan. The 2025 Plan is effective as of March 31, 2025; however, the 2025 Plan is subject to approval of our stockholders which the Company is seeking at its annual meeting of stockholders schedule for June 25, 2025. The prior 2015 Plan expires on June 29, 2025. See Note 6.

| F-12 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

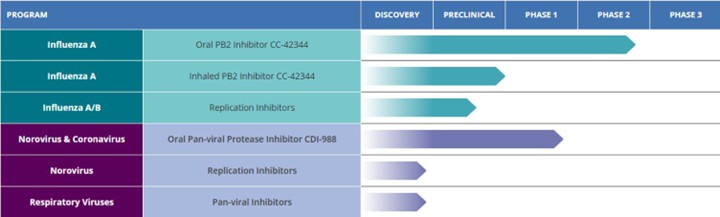

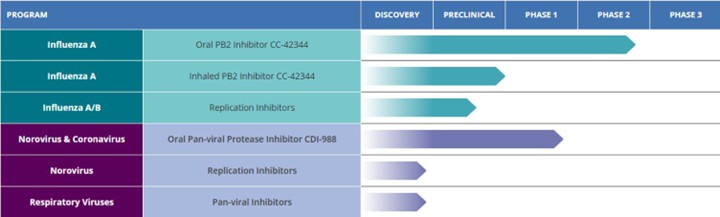

Cocrystal Pharma, Inc. (the “Company” or “Cocrystal”) is a clinical-stage biotechnology company seeking to discover and develop novel antiviral therapeutics as treatments for serious and/or chronic viral diseases. We employ unique structure-based technologies and Nobel Prize winning expertise to create first- and best-in-class antiviral drugs. These technologies are designed to efficiently deliver small molecule therapeutics that are safe, effective and convenient to administer. We have identified promising preclinical and clinical-stage antiviral compounds for unmet medical needs including influenza virus, coronavirus, norovirus and hepatitis C virus (“HCV”).

Impact of Inflation

The Company believes that inflation has not had a material effect on its operations to date, other than the impact of inflation on the general economy. However, there is a risk that the Company’s operating costs could become subject to inflationary pressures in the future particularly based upon United States tariff policy, which could have a material effect on increasing the Company’s operating costs, and which would put additional stress on the Company’s working capital resources.

Research and Development Update

During the three months ended March 31, 2025 and more recently the Company continued to focus its research and development efforts primarily in three areas of norovirus, coronavirus and influenza.

Influenza Program

We have several candidates under development for the treatment of influenza infection. CC-42344, a novel PB2 inhibitor, was selected as a preclinical lead as an oral or inhaled treatment of pandemic and seasonal influenza A. This candidate binds to a highly conserved PB2 site of influenza polymerase complex (PB1: PB2: PA) and exhibits a novel mechanism of action. CC-42344 showed excellent in vitro antiviral activity against influenza A strains, including avian pandemic strains and Tamiflu® and Xofluza® resistant strains, and has favorable pharmacokinetic and drug resistance profiles.

In addition to the oral candidate of CC-42344, inhaled CC-42344 is being developed for the potential prophylactic treatment of pandemic and seasonal influenza infections. Dry powder inhalation development and toxicology studies have been evaluated.

We received authorization from the United Kingdom Medicines and Healthcare Products Regulatory Agency (MHRA) to conduct a Phase 2a human challenge study with oral CC-42344 as a potential treatment for pandemic and seasonal influenza A. This randomized, double-blind, placebo-controlled study is designed to evaluate the safety, tolerability, viral and clinical measurements of healthy subjects infected with the influenza A virus dosed with oral CC-42344 treatment. In May 2024 we announced the completion of enrollment of 78 subjects.

| 3 |

In December 2024, the Company announced plans to extend enrollment for the oral CDI-42344 Phase 2a study due to an unexpectedly low influenza infection among study participants. Specifically, management determined that an extension of the study is necessary due to low infectivity rate of the challenge influenza strain used in this study, as the establishment of robust influenza infection in healthy, uninfected study subjects is critical to determine clinical endpoints for evaluating antiviral molecule, and the low infectivity obtained in this study hindered antiviral data analysis. The Company is currently in continuing discussions with the clinical research organization to address this study and determine a course forward with respect thereto, including potentially preparing a protocol amendment or a resubmission for approval by the MHRA in order to seek enrollment of additional healthy subjects infected with the influenza A virus to ensure necessary infection rates to secure sufficient data for analysis. CC-42344 has demonstrated favorable safety and tolerability profile from the Phase 2a study to date, with no SAEs and no drug-related discontinuations by study participants.

In June 2024 we reported the potential efficacy of CC-42344 against the new Texas avian flu strain from in vitro studies with the recently published genome sequence for H5N1. Using our proprietary structure-based platform technology, the Company reported a high-resolution cocrystal structure of this avian PB2 protein complexed with CC-42344 and confirmed that CC-42344 binds to its highly conserved PB2 region. The in vitro data using purified Texas avian H5N1 PB2 protein further showed in vitro affinity of CC-42344 similar to that of previous data using pandemic avian and seasonal influenza A PB proteins.

We also continue developing novel broad-spectrum influenza antivirals targeting replication enzymes of seasonal and pandemic influenza A and B strains.

Norovirus and Coronavirus Programs

We developed the novel protease inhibitor CDI-988 as an oral pan-viral treatment of noroviruses and coronaviruses, including SARS-CoV-2 and its variants. CDI-988 was specifically designed and developed using our proprietary structure-based drug discovery platform technology as a broad-spectrum antiviral inhibitor to a highly conserved region in the active site of noroviruses, coronaviruses and other 3CL viral proteases. We believe CDI-988 represents a first-in-class pan-viral antiviral for the treatment of viral gastroenteritis caused by noroviruses and coronaviruses, including SARS-CoV-2 and its variants.

Oral CDI-988 is being clinically evaluated for safety, tolerability and pharmacokinetics including a food-effect cohort in healthy volunteers in a single-center, randomized, double-blind, placebo-controlled Phase 1 study being conducted in Australia. We expect that the oral CDI-988 Phase 1 data will support future norovirus and coronavirus Phase 2 and Phase 3 studies.

In July 2024 we announced favorable safety and tolerability results from the single-ascending dose (SAD) cohorts of the Phase 1 study with CDI-988. Study participants in the SAD cohorts received CDI-988 in doses ranging from 100 mg to 600 mg. All participants completed the study with no discontinuations. There were no serious adverse events or severe treatment-emergent adverse events. No clinically significant observations were noted in laboratory assessments, physical exams or electrocardiograms.

In September 2024 we initiated dosing of the first subjects in the multiple-ascending dose (MAD) portion of the Phase 1 study with CDI-988. In January 2025 we reported topline results from the MAD portion of the Phase 1 study showing that CDI-988 administered at 800 mg, the highest dose tested, for 10 consecutive days was safe and well tolerated. We also announced an additional cohort for a higher dose of 1,200 mg and a shorter treatment duration of five consecutive days to further assess CDI-988’s safety, tolerability and pharmacokinetics. Results from the high-dose cohort are expected to be released in the first half of 2025.

| 4 |

Therapeutic Targets

Influenza: A worldwide public health problem, including the potential for pandemic Avian Flu

Influenza is a severe respiratory illness, caused primarily by influenza A or B viruses. Influenza A viruses are the only influenza viruses known to cause influenza pandemics. Each year there are approximately 1 billion cases of seasonal influenza worldwide, with 3-5 million severe illnesses and up to 650,000 deaths, according to the World Health Organization (“WHO”). On average about 8% of the U.S. population contracts influenza each season, according to the Centers for Disease Control and Prevention (“CDC”). In addition to the health risk, influenza is responsible for approximately $10.4 billion in direct medical costs in the U.S. annually, according to the National Institutes of Health (“NIH”).

Currently approved antiviral treatments for influenza are effective but burdened with significant viral resistance. Strains of influenza virus resistant to the approved treatments oseltamivir phosphate (Tamiflu®), zanamavir (Relenza®) and baloxavir marboxil (Xofluza®) have appeared and in some cases are predominant. For example, the predominant strain of the 2009 swine influenza pandemic was resistant to oseltamivir. Oseltamivir inhibits influenza neuraminidase enzymes, which are not highly conserved between viral strains. According to the WHO, approximately 15% of the H1N1 isolates circulating worldwide were oseltamivir resistant. Also, treatment-emergent resistance to recently approved baloxavir has been observed during clinical trials and the potential transmission of resistant influenza variants could significantly diminish baloxavir effectiveness.

Norovirus: A worldwide public health problem responsible for close to 90% of the global epidemic, non-bacterial outbreaks of gastroenteritis with no effective treatment or vaccine

Norovirus is a very common and highly contagious virus that causes symptoms of acute gastroenteritis among people of all ages including nausea, vomiting, stomach pain and diarrhea as well as fatigue, fever and dehydration. Norovirus infection can be significantly more severe and prolonged in specific risk groups including infants, children, the elderly and people with immunodeficiency. In immunosuppressed patients, chronic norovirus infection can lead to a debilitating illness with extended periods of nausea, vomiting and diarrhea. Norovirus outbreaks occur most commonly in semi-closed communities and have become notorious for their occurrence in hospitals, nursing homes, childcare facilities, cruise ships, schools, disaster relief sites and military settings.

In the U.S. alone, noroviruses are the leading cause of vomiting and diarrhea from acute gastroenteritis among people of all ages and responsible for an estimated 21 million cases annually, including 109,000 hospitalizations, 465,000 emergency department visits and an estimated 900 deaths, according to the CDC. The NIH estimates the annual burden to the United States at $10.6 billion.

According to the CDC, noroviruses average 685 million cases of acute gastroenteritis worldwide. Noroviruses are responsible for up to 1.1 million hospitalizations and 218,000 deaths annually in children in the developing world.

There is currently no effective treatment or effective vaccine for norovirus, and the ability to curtail outbreaks is limited. We are developing a novel norovirus antiviral candidate for the prophylactic and therapeutic treatment of norovirus infection that is currently in a Phase 1 clinical study. A few companies have been developing vaccines and are in stages of clinical testing, including Vaxart Pharmaceutical, Moderna, Hillevax, Takeda Pharmaceuticals, Anhui Zhifei Longcom Biopharmaceutical (China) and National Vaccine and Serum Institute (China).

Coronavirus: COVID-19 continues to be a global pandemic fueled by an emergence of new strains

COVID-19 is a global health concern responsible for more than 777 million reported cases globally, including more than 7 million deaths, as of March 2025, according to data reported by the WHO.

Coronaviruses (CoV) are a large family of RNA viruses that historically have been associated with illness ranging from mild symptoms similar to the common cold to more severe respiratory disease. Infection with the novel SARS-CoV-2 has been associated with a wide range of responses, from no symptoms to more severe disease that has included pneumonia, severe acute respiratory syndrome, kidney failure, and death. The incubation period for SARS-CoV-2 is believed to be within 14 days after exposure, with most illness occurring within about five days after exposure. SARS-CoV-2, like other RNA viruses, is prone to mutate over time, resulting in the emergence of multiple variants. Adaptive mutations in the viral genome can alter the virus’s pathogenic potential. Even a single amino acid exchange can drastically affect a virus’s ability to evade the immune system and complicate the vaccine and antibody therapeutics development against the virus. Based on an epidemiological update by the WHO, five SARS-CoV-2 VOCs (variants of concern) have been identified since the beginning of the pandemic. Also, as demonstrated in the Delta, Omicron and other variants, some variations allow the virus to spread more easily and make it resistant to the treatments and vaccines.

| 5 |

On October 22, 2020, the U.S. Food and Drug Administration (“FDA”) approved the antiviral drug Veklury® (remdesivir) for the treatment of COVID-19 requiring hospitalization. Remdesivir is a nucleotide prodrug that inhibits viral replication and was previously evaluated in clinical trials for Ebola treatment in 2014. On May 25, 2023, the FDA approved Paxlovid™ (nirmatrelvir tablets and ritonavir tablets, co-packaged for oral use) for the treatment of mild-to-moderate COVID-19 in adults who are at high risk for progression to severe COVID-19, including hospitalization or death. For certain hospitalized adults with COVID-19, the FDA has also approved Olumiant® (baricitinib) and Actemra® (tocilizumab). In addition, the FDA issued emergency use authorization (EUA) for several antibody and antiviral therapeutics, including and Lagevrio™ (molnupiravir).

We continue pursuing the development of novel antiviral compounds for the treatment of coronavirus infections using our established proprietary drug discovery platform. By targeting the viral replication enzymes and protease, we believe it is possible to develop an effective treatment for all coronavirus diseases including COVID-19, Severe Acute Respiratory Syndrome (SARS), and Middle East Respiratory Syndrome (MERS).

Hepatitis C: A large competitive market with opportunity for shorter treatment regimens

HCV is a highly competitive and changing market. Since 2014, several combinations of direct-acting antiviral agents (“DAAs”) have been approved for the treatment of HCV infection. These include Harvoni (sofosbuvir/ledipasvir) 12 weeks of treatment, Viekira Pak (ombitasvir/paritaprevir/ritonavir, dasabuvir) twelve weeks of treatment, Epclusa (sofosbuvir/velpatasvir) twelve weeks of treatment, Zepatier (elbasvir/grazoprevir) twelve weeks of treatment and Mavyret (glecaprevir/pibrentasvir) eight weeks of treatment. We believe the next improvements in HCV treatment will be ultra-short combination oral treatments of four to six weeks, which is the goal of our program.

We anticipate a significant global HCV market opportunity that will persist through at least 2036, given the large prevalence of HCV infection worldwide. The 2024 World Health Organization Global Hepatitis Report estimates that 50 million people worldwide have chronic HCV infections with about 1 million new infections occurring per year and an estimated 3.2 million adolescents and children with chronic HCV infection. In July 2023, WHO published that globally, an estimated 58 million people have chronic HCV infection, with about 1.5 million new infections occurring per year, and an estimated 3.2 million adolescents and children with chronic HCV infection.

We are targeting the viral NS5B polymerase with an NNI, which could be developed as part of an all-oral, pan-genotypic combination regimen. Our focus is on developing what is now called ultrashort treatment regimens from four to six weeks in length. Such a combination treatment CC-31244 with different classes of approved DAAs has the potential to change the paradigm of treatment for HCV with a shorter duration of treatment. Combination strategies with approved drugs could allow us to expand CC-31244 into the HCV antiviral therapeutic area globally and could lead to a high and fast cure rate, to improved compliance, and to reduced treatment duration. To our knowledge no competing company has yet developed a short HCV treatment of less than 8 weeks with a high (>95%) sustained virologic response (SVR) at week 12.

CC-31244, an HCV NNI, is a potential best in class pan-genotypic inhibitor of NS5B polymerase for the treatment of HCV. The Company completed a Phase 1a/b study in Canada in September 2016, with favorable safety results in a randomized, double-blinded, Phase 1a/b study in healthy volunteers and HCV-infected subjects. The Company completed a Phase 2a study in HCV genotype 1 subjects in the United States. Cocrystal presented the interim results from the Phase1a/b study at the APASL in February 2017. HCV-infected subjects treated with CC-31244 had a rapid and marked decline in HCV RNA levels, and slow viral rebound after treatment. Results of this study suggest that CC-31244 could be an important component in a shortened duration all-oral HCV combination therapy. The Company has completed the Phase 2a final study report as filed with the FDA. See “Item 1 – Business – Research and Development Update – Hepatitis C” in our Annual Report on Form 10-K for the year ended December 31, 2024 for more information.

The Company has been seeking a partner for further clinical development of CC-31244 since completing Phase 2a trials.

| 6 |

Results of Operations for the Three Months Ended March 31, 2025 compared to the Three Months Ended March 31, 2024

Research and Development Expense

Research and development expense consists primarily of compensation-related costs for our employees dedicated to research and development activities and clinical trials, as well as lab supplies, lab services, and facilities and equipment costs related to our research and development programs.

Total research and development expenses for the three months ended March 31, 2025, and 2024 were $1,360,000 and $2,950,000, respectively. The decrease of $1,590,000 was primarily due to a reduction in salary and related costs and our Influenza CC-42344 product candidate moving out of Phase 2a clinical trial and the finalizing of the Phase 1 clinical trial of norovirus and coronavirus candidate CDI-988.

General and Administrative Expense

General and administrative expenses include compensation-related costs for our employees dedicated to general and administrative activities, legal fees, audit and tax fees, consultants and professional services, and general corporate expenses.

General and administrative expenses for the three months ended March 31, 2025, and 2024 were $981,000 and $1,208,000, respectively. The decrease of $227,000 was due to a reduction in insurance cost and other general and administrative expense.

Interest Income, Net

Interest income for the three months ended March 31, 2025 and 2024 was $37,000 and $220,000, respectively. The interest income was primarily earned on cash held in interest bearing bank accounts.

Other Income (Expense)

During the period ending March 31, 2024, the Company had 11,000 warrants accounted as liabilities that expired; no warrants remain outstanding at this time.

In 2022, the Company established a wholly owned subsidiary in Australia, making it subject to foreign exchange rate fluctuations. Foreign exchange gain of $3,000 was recorded for the three months ended March 31, 2025 compared to a foreign exchange loss of $18,000 during the three months ended March 31, 2024.

Income Taxes

No income tax benefit or expense was recognized for the three months ended March 31, 2025 and 2024. The Company’s effective income tax rate was 0.00% for the three months ended March 31, 2025 and 2024. As a result of the Company’s cumulative losses, management has concluded that a full valuation allowance against the Company’s net deferred tax assets is appropriate.

Net Loss

As a result of the above factors, net loss for the three months ended March 31, 2025 was $2,301,000 compared with a net loss of $3,956,000 for the three months ended March 31, 2024, respectively, as a result of developments related to our expenses described above.

Liquidity and Capital Resources

Net cash used in operating activities was $2,939,000 for the three months ended March 31, 2025 compared with net cash used in operating activities of $4,503,000 for the same period in 2024. This decrease was primarily due to decrease in period expenses related to our Influenza A Phase 2a clinical trial.

No cash was used for investing activities during the three months ended March 31, 2025 compared with $8,000 net cash used for the same period in 2024. For the three months ended March 31, 2025 the level of investments decreased compared with March 31, 2024 due to comparative reduction in purchases of laboratory equipment in 2025.

No cash was used for financing activities during the three months ended March 31, 2025 and for the same period in 2024 due to sufficient capital resulting in a lack of financing activity in the 2025 period.

The Company has not yet established an ongoing source of revenue sufficient to cover its operating costs. The Company had $6,921,000 unrestricted cash on March 31, 2025. We expect that our reported cash balance is not be sufficient to support the Company’s working capital needs for the 12 months following the filing of this report, taking into account our intended research and development efforts in the remainder of 2025 and beyond.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is capital-intensive. As a rule, research and development expenses increase substantially as a company advances a product candidate toward clinical programs. Historically, we have financed our operations with the proceeds from public and private equity and debt offerings, including additional investments by certain existing stockholders, and entered into strategic partnerships and collaborations for the research, development and commercialization of product candidates.

| 7 |

We have focused our efforts on research and development activities, including through collaborations with suitable partners. We have been profitable on a quarterly basis but have never been profitable on an annual basis. We have no products approved for sale and have incurred operating losses and negative operating cash flows on an annual basis since inception.

The Company’s interim consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Historically, public and private equity offerings have been our principal source of liquidity.

The Company is party to the At-The-Market Offering Agreement, dated July 1, 2020 (“ATM Agreement”) with H.C. Wainwright & Co., LLC (“Wainwright”), pursuant to which the Company may issue and sell over time and from time to time, to or through Wainwright, up to $10,000,000 of shares of the Company’s common stock. During January 2021, the Company sold 1,030,000 shares of its common stock pursuant to the ATM Agreement for net proceeds of approximately $2,072,000. On May 24, 2023, the Company filed a prospectus supplement covering sales under the ATM Agreement under which we may offer and sell shares of our common stock having an aggregate offering price of up to $7,250,000 from time to time through Wainwright. There were no sales under the ATM Agreement during the three months ended March 31, 2025.

As the Company continues to incur losses, achieving profitability is dependent upon the successful development, approval and commercialization of its product candidates, and achieving a level of revenues adequate to support the Company’s cost structure. The Company may never achieve profitability, and unless and until it does, the Company will continue to need to raise additional capital. Management intends to fund future operations through additional private or public equity offerings and through arrangements with strategic partners or from other sources. There can be no assurances, however, that additional funding will be available on terms acceptable to the Company, or at all, and any equity financing may be very dilutive to existing stockholders.

Cautionary Note Regarding Forward-Looking Statements

This report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future effectiveness of our product candidates, our plans for the future development of preclinical and clinical drug candidates, the expected time of achieving certain value driving milestones in our programs and progressing our programs in the clinical development process generally, our expectations regarding future operating results and liquidity. The words “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,” “is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs.

The results anticipated by any or all of these forward-looking statements might not occur. Important factors that could cause actual results to differ from those in the forward-looking statements include the risks and uncertainties arising from the risks arising from the possibility of a recession, interest rate increases, and the economic impact of United States tariff policies geopolitical conflicts including inflation, the wars in Israel and Ukraine on our Company, our collaboration partners, and on the U.S., U.K., Australia and global economies, including downturns in economic activity and capital markets, manufacturing and research delays arising from raw materials and labor shortages, supply chain disruptions and other business interruptions including any adverse impacts on our ability to obtain raw materials and test animals as well as similar problems with our vendors and our current and any future contract research organizations (CROs) and contract manufacturing organizations (CMOs), the progress and results of the studies for CC-42344 and CDI-988 including the delay of the Phase 2a study for CC-42344 which may require us to incur substantial additional costs, the results of the studies for CC-42344 and CDI-988 and any future preclinical and clinical trials, the ability of our CROs to recruit volunteers for, and to proceed with, clinical studies, and our collaboration partners’ technology and software performing as expected, financial difficulties experienced by certain partners, general risks arising from clinical trials, receipt of regulatory approvals and changes including based on initiatives and actions taken by the Trump Administration which could, among other things, result in delays in regulatory approvals or limit access to federal funding for our programs regulatory changes, development of effective treatments and/or vaccines by competitors, including as part of the programs financed by governmental authorities and potential mutations in a virus we are targeting which may result in variants that are resistant to a product candidate we develop. Further information on our risk factors is contained in our filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2024. We undertake no obligation to publicly update or revise any forward-looking statements, whether as the result of new information, future events or otherwise.

| 8 |

Critical Accounting Policies and Estimates

In our Annual Report on Form 10-K for the year ended December 31, 2024, we disclosed our critical accounting policies and estimates upon which our financial statements are derived.

Accounting estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ significantly from these estimates.

Readers are encouraged to review these disclosures in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 in conjunction with the review of this report.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We carried out an evaluation, under the supervision and with the participation of our management, including our Co-Chief Executive Officers and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934 (the “Exchange Act”) as of the end of the period covered by this report. Based on that evaluation, our Co-Chief Executive Officers and Chief Financial Officer have concluded that our disclosure controls and procedures as of March 31, 2025 were effective to ensure that information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

Changes in Internal Control over Financial Reporting

There were no material changes in our internal controls over financial reporting or in other factors that could materially affect, or are reasonably likely to affect, our internal controls over financial reporting during the quarter ended March 31, 2025. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

| 9 |

PART II — OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

From time to time, the Company is a party to, or otherwise involved in, legal proceedings arising in the normal course of business. During the reporting period, there have been no material changes to the description of legal proceedings set forth in our Annual Report on Form 10-K for the year ended December 31, 2024.

ITEM 1.A RISK FACTORS

None.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

All recent sales of unregistered securities have been previously reported.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION

During the three months ended March 31, 2025, none

of our directors or officers (as defined in Rule 16a-1(f) under the Exchange Act)

ITEM 6. EXHIBITS

The exhibits listed in the accompanying “Exhibit Index” are filed or incorporated by reference as part of this Form 10-Q.

EXHIBIT INDEX

| Exhibit | Incorporated by Reference |

Filed or Furnished | ||||||||

| No. | Exhibit Description | Form | Date | Number | Herewith | |||||

| 3.1 | Certificate of Incorporation, as amended | 10-Q | 8/16/21 | 3.1 | ||||||

| 3.1(a) | Certificate of Amendment to Certificate of Incorporation | 8-K | 10/3/22 | 3.1 | ||||||

| 3.2 | Amended and Restated Bylaws | 8-K | 2/19/21 | 3.1 | ||||||

| 31.1 | Certification of Principal Executive Officer (302) | Filed | ||||||||

| 31.2 | Certification of Principal Executive Officer (302) | Filed | ||||||||

| 31.3 | Certification of Principal Financial Officer (302) | Filed | ||||||||

| 32.1 | Certification of Principal Executive and Principal Financial Officer (906) | Furnished* | ||||||||

| 101.INS | Inline XBRL Instance Document | Filed | ||||||||

| 101.SCH | Inline XBRL Taxonomy Extension Schema Document | Filed | ||||||||

| 101.CAL | Inline XBRL Taxonomy Extension Calculation Linkbase Document | Filed | ||||||||

| 101.DEF | Inline XBRL Taxonomy Extension Definition Linkbase Document | Filed | ||||||||

| 101.LAB | Inline XBRL Taxonomy Extension Label Linkbase Document | Filed | ||||||||

| 101.PRE | Inline XBRL Taxonomy Extension Presentation Linkbase Document | Filed | ||||||||

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | Filed | ||||||||

* This exhibit is being furnished rather than filed and shall not be deemed incorporated by reference into any filing, in accordance with Item 601 of Regulation S-K.

Copies of this report (including the financial statements) and any of the exhibits referred to above will be furnished at no cost to our stockholders who make a written request to our Corporate Secretary at Cocrystal Pharma, Inc., 4400 Biscayne Blvd, Suite 101, Miami, FL 33137.

| 10 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Cocrystal Pharma, Inc. | ||

| Dated: May 15, 2025 | By: | /s/ Sam Lee |

| Sam Lee | ||

| President and Co-Chief Executive Officer | ||

| (Principal Executive Officer) | ||

| Dated: May 15, 2025 | By: | /s/ James Martin |

| James Martin | ||

| Chief Financial Officer and Co-Chief Executive Officer | ||

| (Principal Executive Officer and Principal Financial Officer) | ||

| 11 |